Aflac is a supplemental insurance company (popularized by the loud Aflac duck) with roots going back to 1955 covering numerous workplace offerings, such as accident, short-term disability, and life insurance.

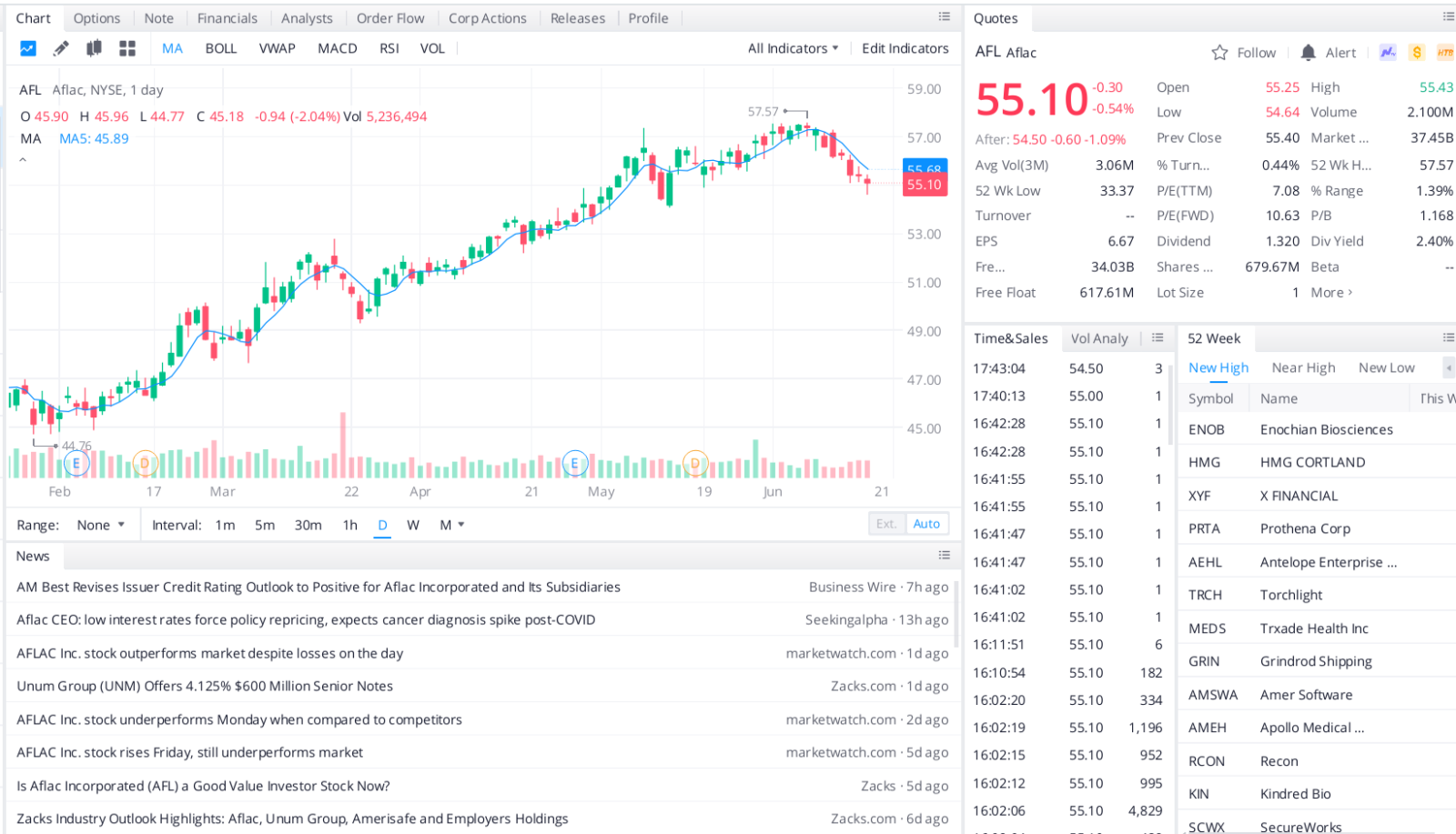

The pandemic has done a number on insurers, and AFL shares remain down by more than 10% over the past year. Analysts’ consensus recommendation on the stock is ‘Hold.’ Investors should be heartened by Aflac’s ability to increase both revenue and earnings during the fourth quarter ended Dec. 31. And they shouldn’t have to fret about the dividend.

The payout is a highly conservative 12% of profits, for one thing. And in November 2020, Aflac lifted its quarterly dividend for the 39th consecutive year, this time by a whopping 17.9% to 33 cents per share.

Though Aflac Incorporated might be a good choice for value investors, there are plenty of other factors to consider before investing in this name. The company’s recent earnings estimates have been encouraging. The current year estimate witnessed six upward revisions in the past sixty days compared to no downward revision. The full-year 2022 estimate saw two upward revisions compared to no downward revision in the same period.

Top headlines you shouldn’t miss

Seven value stock picks for common sense investors

How to diversify your portfolio by investing in small businesses

Is digital currency investing or gambling? Here’s what to know

Investing isn’t all or nothing: the case for buffered outcome ETFs

Four soaring airline stocks to invest in this year as travel rebounds

Stocks tumble as Fed keeps policy on hold, raises inflation outlook

Leave a Reply