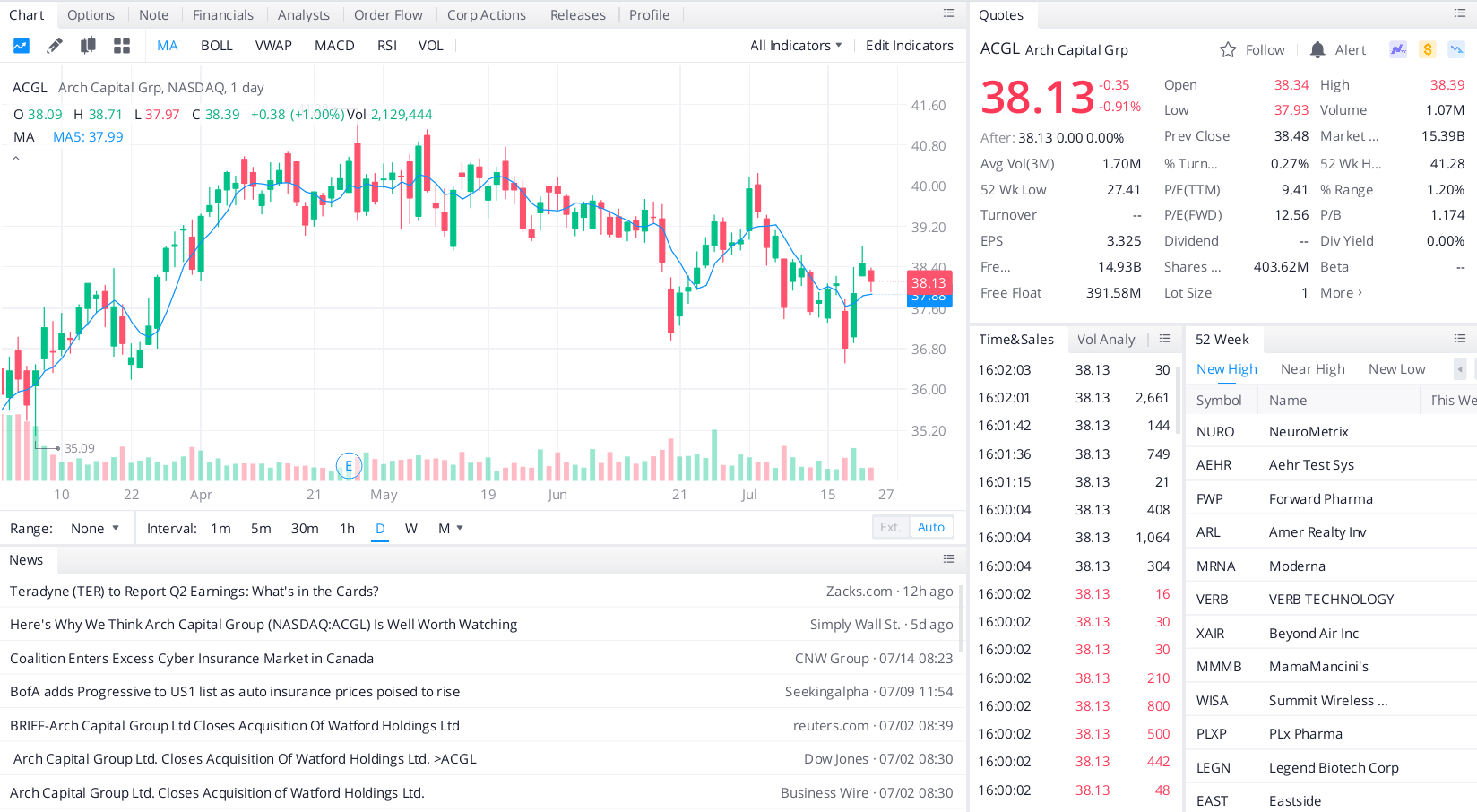

With its subsidiaries, Arch Capital Group Ltd. (ACGL) imparts insurance, additional coverage, and lease insurance products globally. The company was founded in 1995. Arch Capital stock has offered investors 35.29% in the past 12 months.

On January 19, Matthew Carletti, an analyst at JMP Securities, initiated coverage on Arch Capital. He rated the stock as “Market Outperform” and set a price target at $43.00. On March 18, Arch Capital Group entered into a share purchase agreement with the Westpac Group to obtain Westpac Lenders Mortgage Insurance Limited. As a part of the agreement, Westpac Lenders Mortgage Insurance Limited will become Westpac’s provider of new loan originations for ten years.

On April 27, Arch Capital Group Ltd. announced its first-quarter 2021 revenue of $2.5 billion, beating the estimates by $230 million. The company also declared its earnings per share of $0.59, beating the market predictions by $0.15.

King Street Capital holds 1.24 million shares in the firm worth $47.58 million, representing 3.55% of its investment portfolio. King Street Capital has increased its Arch Capital stake by 40% in the first quarter of 2021.

Top headlines you shouldn’t miss

Is the housing market a safer investment than stocks?

With the right investment strategy, you could become a millionaire

Dividends: What are they, and why are they essential to your investment strategy?

How investors should prepare before the crash

Leave a Reply