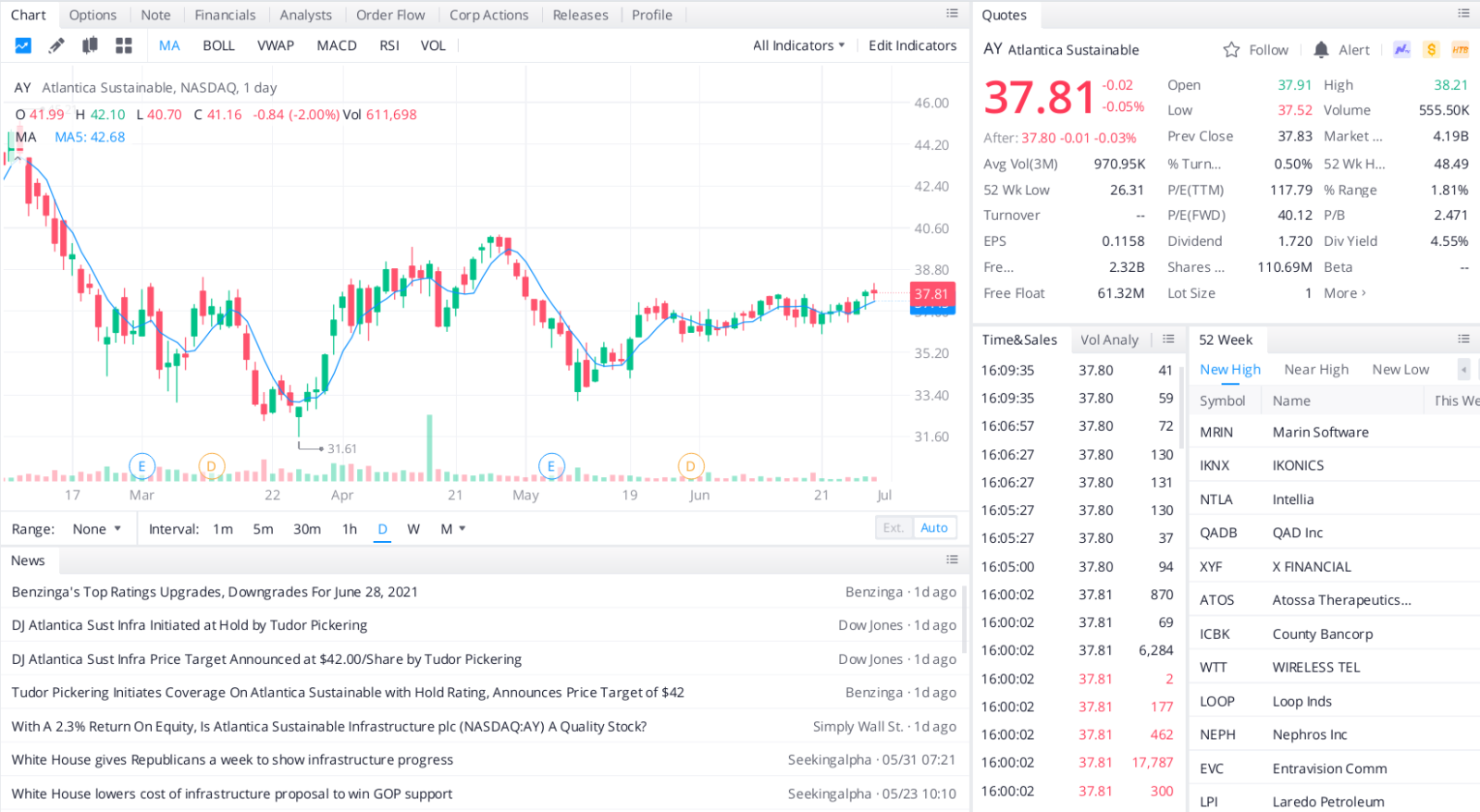

From a wind farm in Uruguay to a solar electric generation facility in California, Atlantica Sustainable Infrastructure invests in the sustainable energy industry.

The U.K.-based company owns or has a stake in solar, wind, hydroelectric, and other sustainable energy facilities and assets in North and South America and specific markets in the EMEA (Europe, Middle East, Asia) region.

Atlantica operates long-running assets – the weighted-average contracted life left is 16 years – with regulated revenues underpinned by contracts, which result in stable cash flows. All of the assets also have project financing in place, the company said.

About 72% of Atlantica’s holdings are in renewables, 14% are in efficient natural gas, 11% is in transmission, and 3% is in water. Per CAFD (cash available for distribution) estimates for the 2021-2025 period, around 41% of AY’s assets are located in North America.

In March, Raymond James analyst David Quezada raised his rating on the stock to Outperform (the equivalent of a Buy). He also has a 12-month target price of $47.

Quezada cited AY’s pullback in the first quarter as one reason for the stock upgrade. However, he also noted that his “constructive” view on the company is due to Atlantica’s “solid” growth in CAFD, a “strong” pace of equity investments, the company’s top ESG standing, and a “strong visibility” on longer-term growth for the business.

Many on Wall Street already have AY on their list of the best green energy stocks. In addition, the consensus analyst rating for Atlantica Sustainable Infrastructure is Strong Buy.

Top headlines you shouldn’t miss

How to build a portfolio that you don’t have to babysit

Are these the best long-term stocks to own right now?

Five dividend stocks to consider buying right now

Two top value stocks to buy now

The best dividend stocks to buy, according to Al Gore

Three reasons to buy traditional energy stocks over solar plays

Leave a Reply