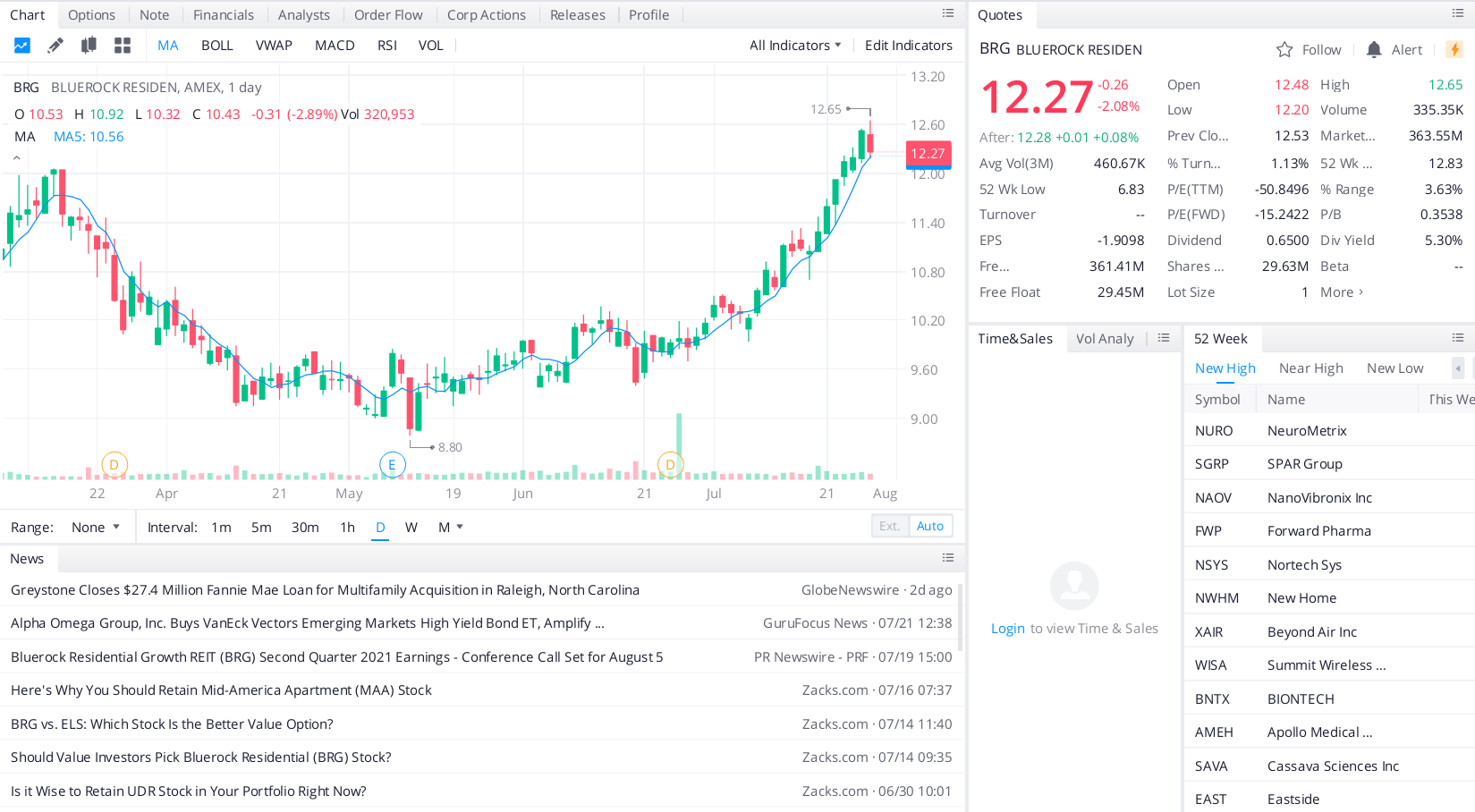

Bluerock Residential Growth REIT invests in high-quality apartment communities across the Sunbelt states. Bluerock owns approximately 17,000 apartments and adds value to its properties via renovations and implementing Smart Home technology.

The REIT has generated 24% returns on the 3,027 apartment renovations completed so far and plans upgrades to another 4,349 units, targeting 20% to 25% returns.

During the second quarter, Bluerock’s occupancy rate rose 150 basis points from the year before 95.8%. Additionally, the REIT collected 97% of rents, and its average lease rate grew 3.5%. As a result, analysts forecast 2021 FFO of 69 cents per share, which is expected to rise 80 cents per share in 2022.

Bluerock pays an annual dividend of 65 cents per share that has held steady since 2018 and is more than covered by FFO. In addition, the REIT demonstrated its resiliency by maintaining its dividend during the pandemic.

BRG holds $260 million of cash, has reasonable debt at 51% of capitalization, and has no significant near-term debt maturities.

Top headlines you shouldn’t miss

Digital currencies can be a tool for building personal wealth long-term

Only this small percentage of Americans traded digital currency in the last year

Three small-cap stocks to buy for the potential rotation

This strong-performing energy ETF gives you access to small-cap value

Don’t miss out on these small-cap dividends that pay up to 9.1%

Leave a Reply