With global emphasis on renewable energy on the rise, the future looks sunny for Canadian Solar. The company is one of the world’s largest manufacturers of solar panels, inverters, and related equipment.

It also manages solar plants globally and provides battery storage solutions. Canadian Solar said it expects revenues to jump 70% year-over-year in 2021 to reach between $5.6 billion to $6 billion in the company’s fiscal first quarter.

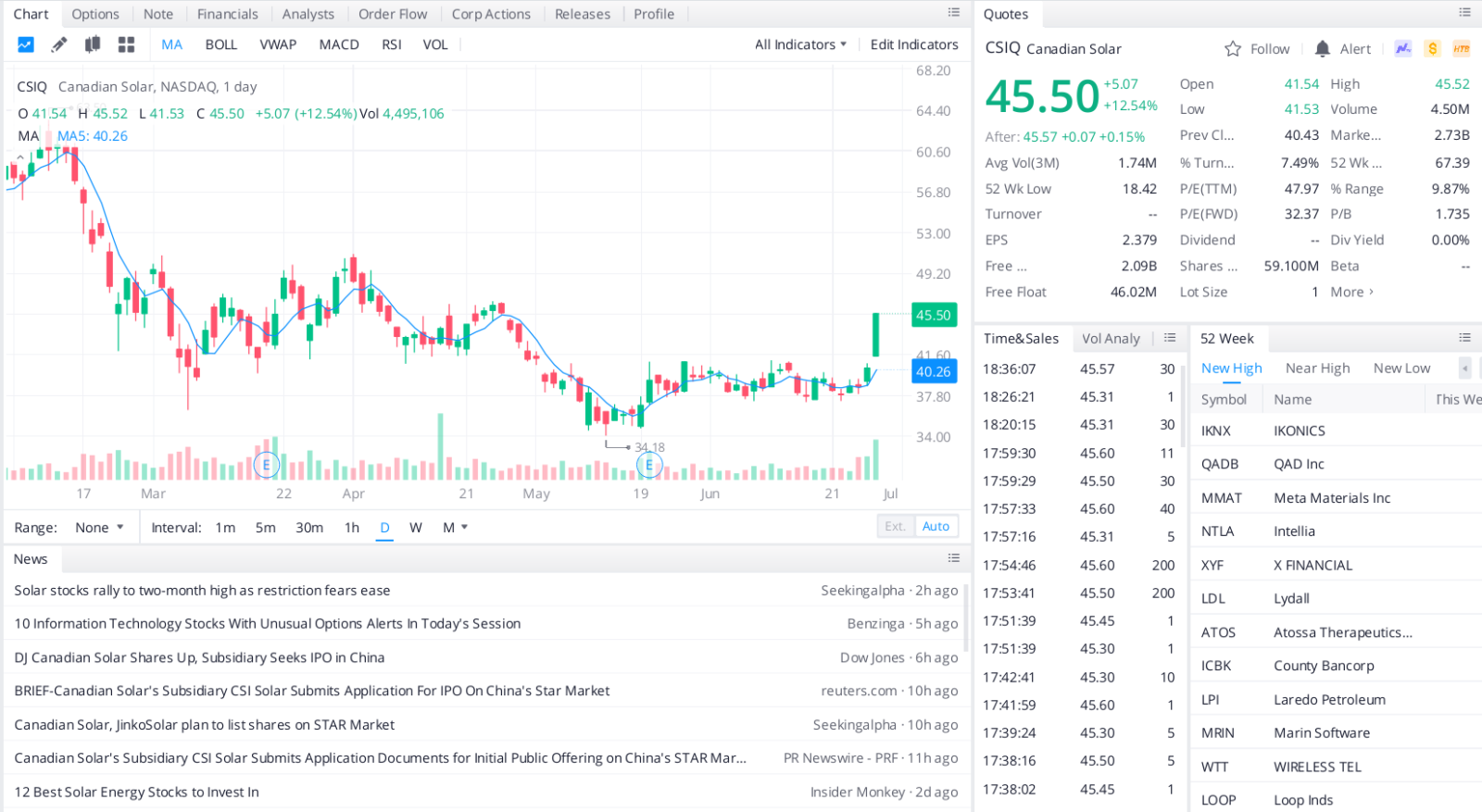

Most analysts think CSIQ is tops among green energy stocks, with the consensus rating sitting at a Strong Buy.

CFRA is a rare dissenter, recently maintaining its Hold rating on Canadian Solar and reducing its 12-month price target on the stock by $6 to $52. That’s mainly on valuation concerns; analyst Stewart Glickman says the price is 5.7 times his firm’s 2022 EBITDA (earnings before interest, taxes, depreciation, and amortization) projection, which is below the company’s forward average valuation.

Glickman notes that rising polysilicon prices remained unabated in the first quarter, leading CSIQ to raise prices sequentially by 10% for modules – its most significant incremental hike ever.

“The company appears to be willing to cede market share to protect margins should cost pressures continue to rise, which we think would be the better option.”

He does say that Canadian Solar expects higher sales volumes in the second half of 2021, and free cash flow – which is the cash left over after capital expenditures, dividend payments, and financial obligations are met – should become positive later this year.

Top headlines you shouldn’t miss

Five warning signs that you are not ready to start investing

Choosing the right strategy could help you become a wealthy investor

Is day trading more profitable than investing?

Leave a Reply