Carparts.com is a beaten-down stock with tremendous upside potential. The Torrance, California-based company specializes in selling all types of automotive parts, including parts for engines, online. In business since 1995 and formerly known as “U.S. Auto Parts,” Carparts.com sells millions of parts and accessories each year.

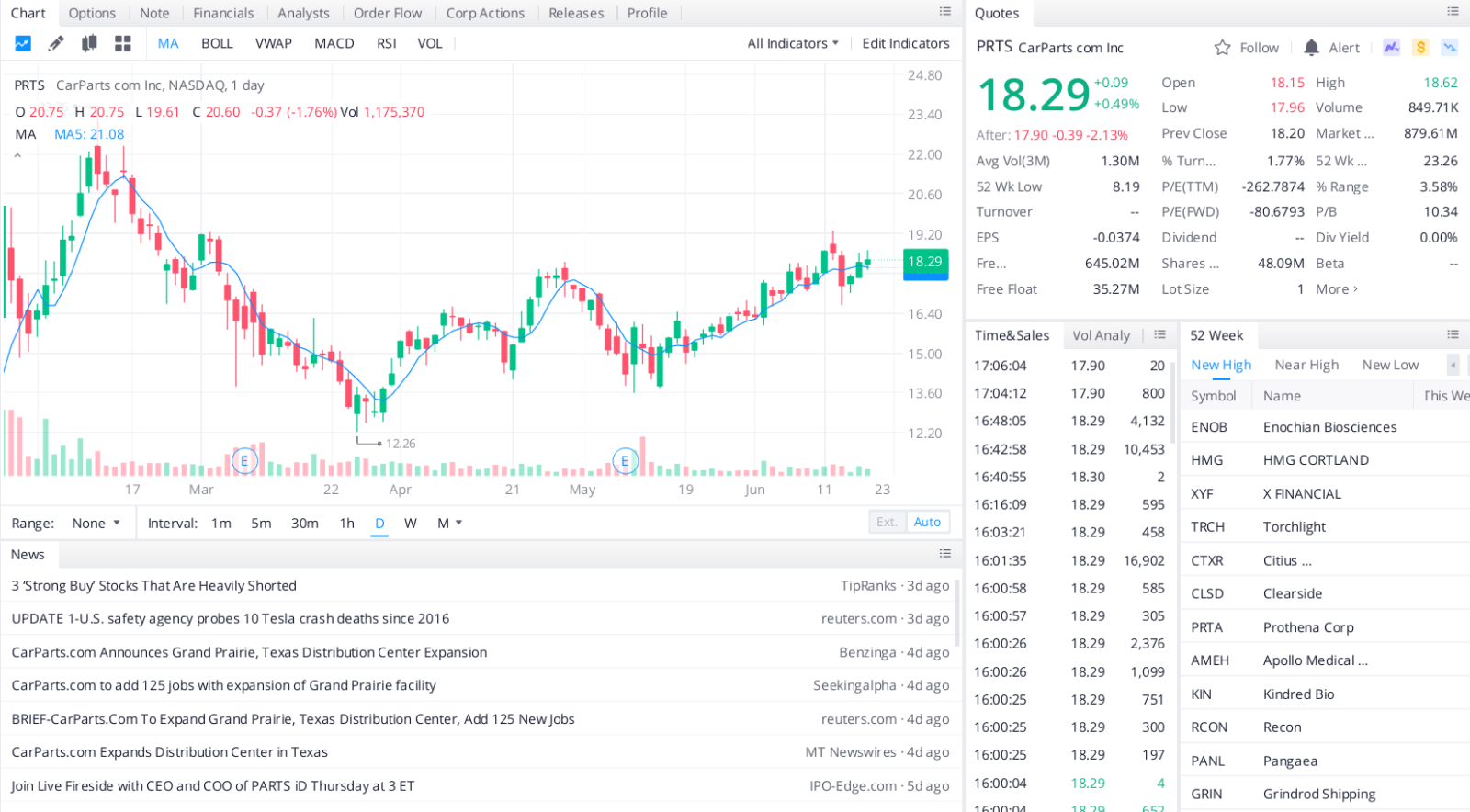

At around $18 a share, PRTS stock is down almost 30% from its 52-week high of $23.26. Despite the decline, analysts remain keen on the stock with a median price target of $24.50, suggesting the share price could rise more than 40% higher than current levels.

The general rotation hurt PRTS stock out of tech plays and into cyclical securities. However, the company’s fundamentals and financial performance justify a higher share price. Carparts.com reported revenues of $144.8 million in their first-quarter earnings, up 65% from a year earlier and far ahead of the $117.5 million expected by analysts. The company’s distribution center in Texas is about 60% full and growing, with plans to increase its total capacity to one million square feet.

The future remains bright for the used car market and the parts needed to sustain it. Used car prices are up nearly 17% since the start of 2021. The global pandemic has Americans buying used rather than new cars as they travel and commute less often, a trend that could continue after the pandemic is behind us.

Top headlines you shouldn’t miss

Are these the best stocks for inflation this year?

Here are five of the best REIT stocks to invest in this month

How this investor woke up a trillionaire after investing $20

Six of the best investments for beginners

Leave a Reply