Enbridge Inc. is an energy infrastructure company operating through five segments: Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storages, Renewable Power Generation, and Energy Services. ClearBridge Investments, an investment management firm, mentioned Enbridge Inc. in its first-quarter 2021 investor letter. The firm commented that Enbridge Inc.’s first quarter saw the market giving the energy sector credit for its leverage to the eventual economic recovery as vaccines continued to get rolled out.

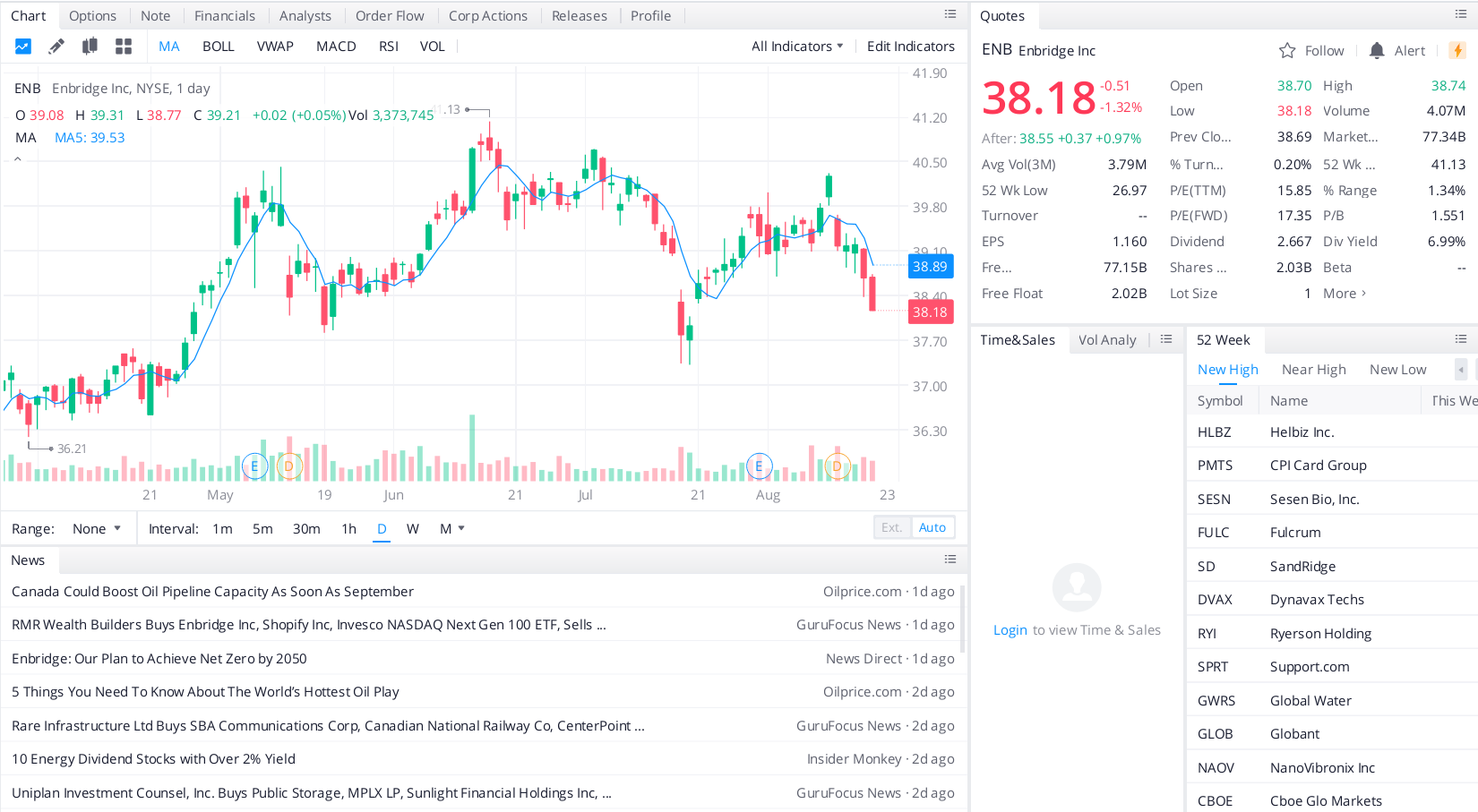

In the first quarter of 2021, Enbridge Inc. had an EPS of $0.67, beating estimates by $0.08. The company’s revenue was $10.04 billion, up 17% year over year and beating estimates by $624.56 million, and it has a gross profit margin of 49.57%. The stock has gained 25.24% in the past six months and year to date.

This June, Credit Suisse upgraded Enbridge Inc. to Outperform with a $44 price target due to lower political and regulatory risks. In addition, Enbridge Inc. made its first move to join the South American market by creating a non-binding offer for the largest natural gas pipeline in Brazil this May.

Enbridge Inc. is a dividend stock worth your consideration.

Top headlines you shouldn’t miss

Ten dividend stocks with over two decades of dividend increases

Three attractive dividend stocks whose payouts could double

Which is the better dividend stock?

Here are the best healthcare dividend stocks you can buy now

Five growth stocks to keep on your watchlist in August 2021

These little-known companies offer big-time growth prospects

Leave a Reply