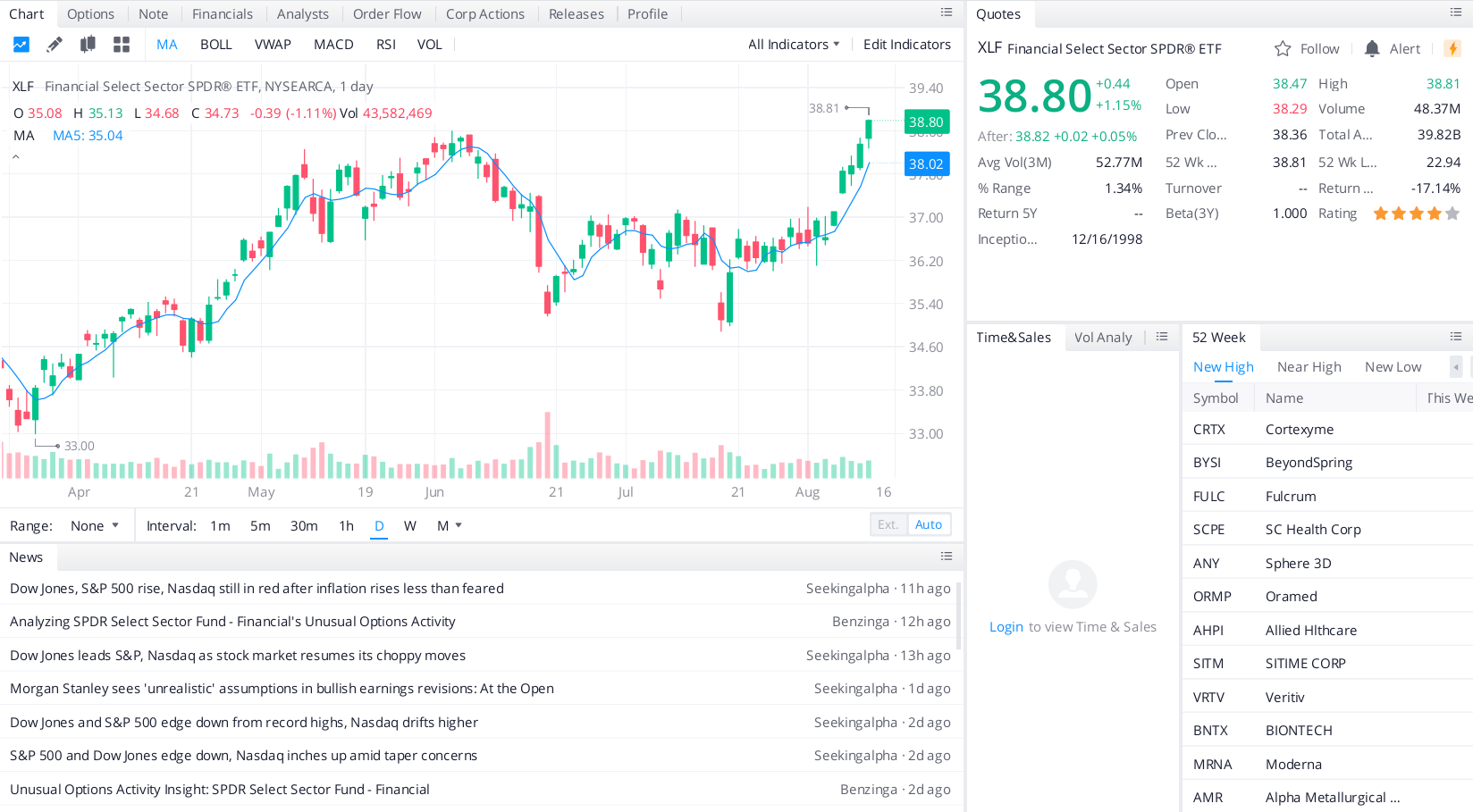

Financial Select Sector SPDR Fund is an exchange-traded fund launched by State Street Global Advisors, Inc., and managed by SSGA Funds Management, Inc. The fund invests in public equity markets in the U.S. and stocks of companies in the finance sector.

On July 5th, UBS estimated that there would be broad-based upgrades in Q2 led by specific sectors like the financials sector led by the Financial Select Sector SPDR Fund, among others. The fund has $41.02 billion in assets under management, and its price returns in the past year have been up 60.82% compared to the S&P 500’s 39.05% increase.

Financial Select Sector SPDR Fund’s total returns have been up 63.94% versus the S&P 500’s total returns increase of 10.4% in the past year. The stock has gained 21.22% in the past six months and 27.03% year to date.

As of the end of the first quarter of 2021, of 866 tracked hedge funds, 30 held stakes in Financial Select Sector SPDR Fund, with a total stake value of about $1.21 billion. This is compared to 32 hedge funds in the previous quarter, with a total stake value of roughly $417 million.

Financial Select Sector SPDR Fund is a solid stock to invest in.

Top headlines you shouldn’t miss

Airline stocks that are worth your consideration for your portfolio

These Warren Buffett stocks offer growth potential along with income

These inexpensive, under-the-radar stocks may be worth buying for the second half of the year

Hot stocks that have outperformed the market are a buy right now

Are these good stocks to buy right now?

The industrial sector is breaking out, and conditions are ripe for traders to act

Leave a Reply