Kinder Morgan is one of the largest energy infrastructure companies globally, with approximately 83,000 miles of pipelines and 144 terminals spread across North America. About 40% of all-natural gas consumed in the United States passes through Kinder Morgan pipelines.

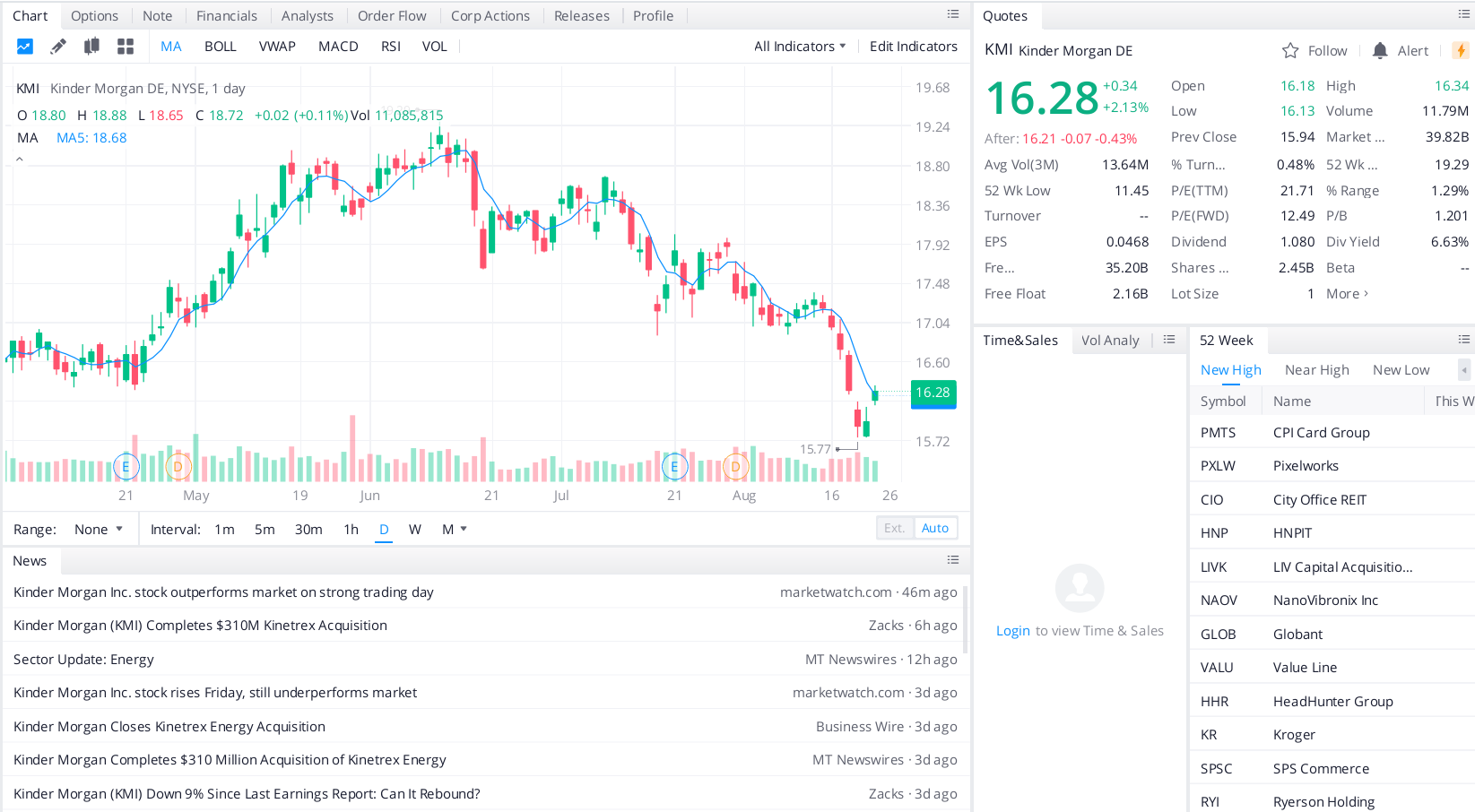

Pipeline stocks have been a no man’s land for years, and Kinder Morgan is no exception. Shares have been trending higher since November 2020 but remain below their pre-pandemic levels and are still more than 60% below their 2015 highs.

In Kinder Morgan, you get the opportunity to buy a cheap stock in an affordable sector that is finally trending higher after years of decline. And you’re getting paid a 6%-plus dividend while you wait!

Simply returning to pre-pandemic levels would mean an upside of nearly 30% from current prices, not including the dividend. That’s not too shabby in a market in which value is getting increasingly difficult to find.

Top headlines you shouldn’t miss

Are these the best digital currency stocks to buy right now?

Eight great low-price stocks to buy now

New investors are breaking the traditional mold when it comes to investing

Investors are terrified… of missing out on the market rally

Before you buy digital currency, consider these three things

Leave a Reply