Qiagen (QGEN, $48.55) had an outstanding start to the year, driven by solid growth of non-coronavirus test products.

No doubt, soaring global demand for test kits that detect the virus was a boon for this diagnostics maker last year. But with the pandemic on the decline, QGEN’s strength has stemmed from non-coronavirus-based products in recent months, with that portion of the portfolio generating first-quarter sales growth of 16%.

These broad-based gains helped drive a 52% top-line increase in the opening quarter and catapulted adjusted profits to 66 cents per share, exceeding management’s expectations. Reported earnings per share surged from 17 cents per share to 56 cents, just about matching Value Line’s call.

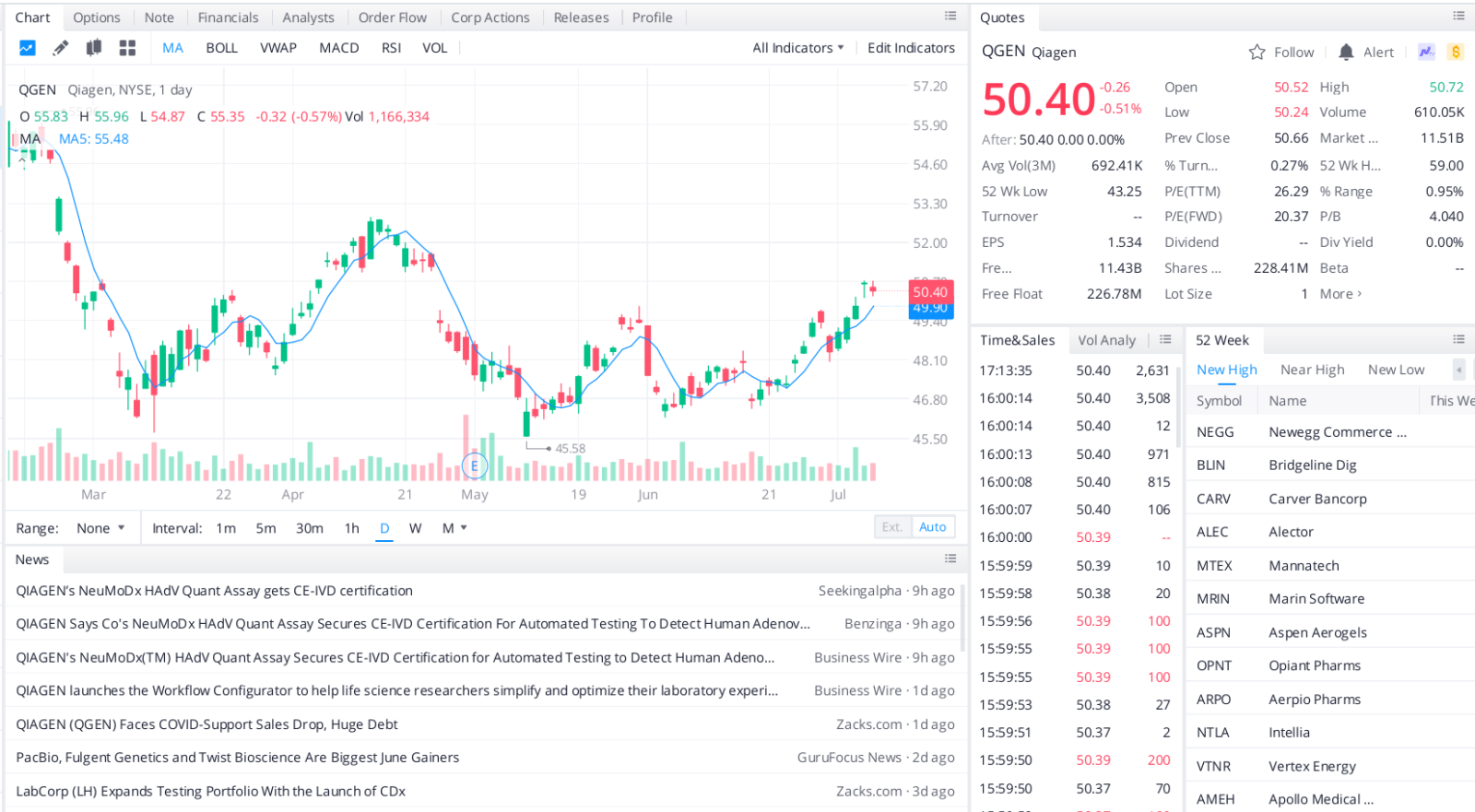

QGEN had been a highflier for some time, but the momentum stalled in February and March after merger rumors fizzled. Now, it is trading at 22.1 times earnings, which is less than half its 10-year average of 47.0.

Our outlook for the remainder of 2021 is positive, thanks to some continued demand for virus testing. These include, for example, the company’s QuantiFERON technology, which is typically used to detect tuberculosis but can also detect Lyme disease. As a result, growth might well taper off in 2022, but it should strengthen after that.

As the pandemic fades and life returns to normal, the coronavirus product category will likely weaken. A broader molecular diagnostics portfolio, expansion into new markets, and acquisitions should be an offset, though. Qiagen is investing in research and development to bolster its competitive position and execute its growth plan beyond the health crisis.

All told, Value Line estimates that earnings will come in at $2.20 this year and reach $2.75 in five years. Compared to the average of 2018 to 2020, annual earnings growth of 25.0% appears obtainable. That, as well as the potential for P/E expansion, makes QGEN one of the best GARP stocks you can buy at the moment.

Top headlines you shouldn’t miss

If you have $100 to spend, these are the best stocks you can buy

Why value investing isn’t just about buying cheap stocks

Here are the most successful cheap stocks ever

The best ways to invest money have been evolving

Leave a Reply