“It’s never too late to retire early”

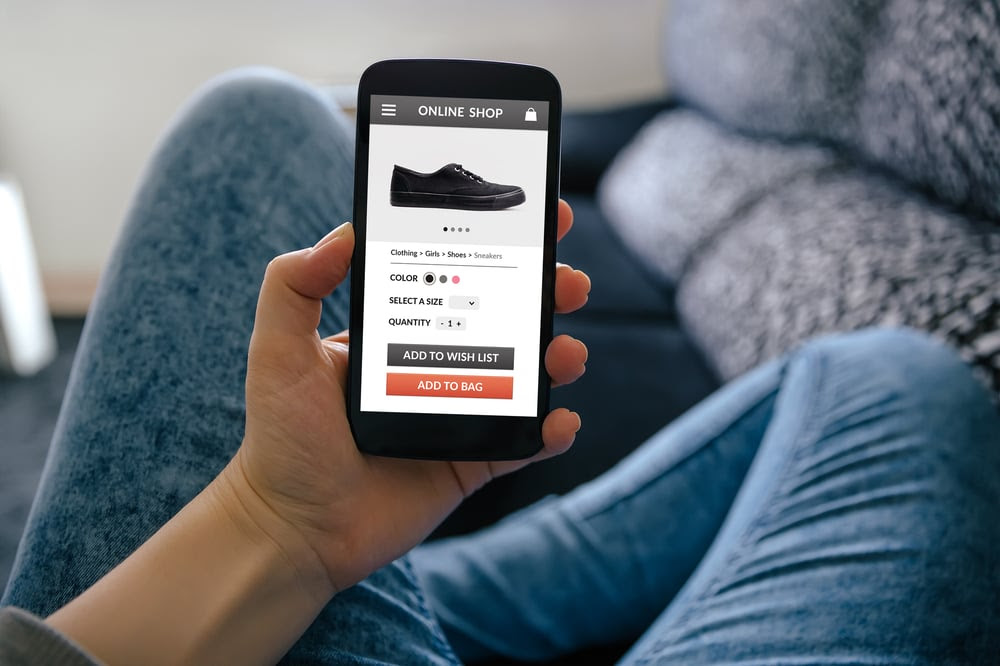

No-brainer stocks to buy in e-commerce

E-commerce was already transforming the way we shop before the pandemic hit. Still, the impact of being stuck at home and reluctant to venture into stores has accelerated the transition. E-commerce sales in the U.S. jumped by 32% last year, doubling from a historical growth rate of around 15%. That growth is expected to continue as retailers keep investing in faster and more convenient delivery, and consumers grow more accustomed to shopping online.

2020 was a banner year for e-commerce stocks, but there are still some great options out there today. These might not be the biggest names in the sector, but they all look like winners over the coming years.

This pick is poised to make you an absolute fortune

Recommended Link:

Paul Mampilly is a Wall Street legend.

(Barron’s crowned his hedge fund as the “world’s best” and Kiplinger ranked it in the top 1%.)

But a few years ago, he left Wall Street.“I just grew tired of helping the rich get richer,” Paul explains. “So I started sharing my No. 1 investment picks with Main Street Americans.”

And his No. 1 stock picks across his various research services have been phenomenal.

In 2017, he recommended Plug Power. It gained 1142% in 3.5 years.

In June 2018, he recommended Tandem Diabetes. It’s currently up 520% and still climbing.

In December 2019, he recommended Enphase Energy. It gained 638% in 1 year. And in March of last year, he recommended Carvana. It’s currently up 877% and still climbing.

But Paul believes his No. 1 stock pick for 2021 could go even higher.

(By clicking this link you will be automatically opted in to Bold Profits Daily)

Top headlines you shouldn’t miss

Warren Buffett doesn’t live like your typical billionaire

Warren Buffett’s $8 billion plan to stop the next Texas blackout

Learn from Warren Buffett to manage your money and start investing

These five tips from one of the world’s wealthiest people can help you get your finances on track, which is step one to start seriously growing your wealth.

Why you should live below your means (like Warren Buffett does)

This is what it takes to be a millionaire?

How to invest like Warren Buffett this year

it’s not hard to see why Buffett’s investing advice and stock moves are so closely followed.

Set the frequency of your newsletter!

Morning, Midday & Night: (Most Popular) Receive your newsletter three times a day

Morning & Night: Receive your newsletter twice a day

Daily: Receive your newsletter once a day

It’s never too late to start saving,

Gordon Fox

P.S.

Know someone who’d love the Never Too Late Investor? Be sure to send them to this link so they can get signed up: investinglate.com

Leave a Reply