“It’s never too late to retire early”

These four dividend stocks could help supplement your Social Security

If dividend stocks are paying your bills in retirement, you don’t need high yield as much as you need income stability and growth. Stability is essential for obvious reasons. It’s not like you can skip a mortgage payment because one of your positions scrapped its dividend for the quarter.

However, dividend growth is nearly as critical. Your retirement might last 30 years or more, and your income over those decades has to keep pace with inflation. If it doesn’t, you’ll start feeling the squeeze in your budget after just a year or two. For retirement income, stability and growth take priority over yield.

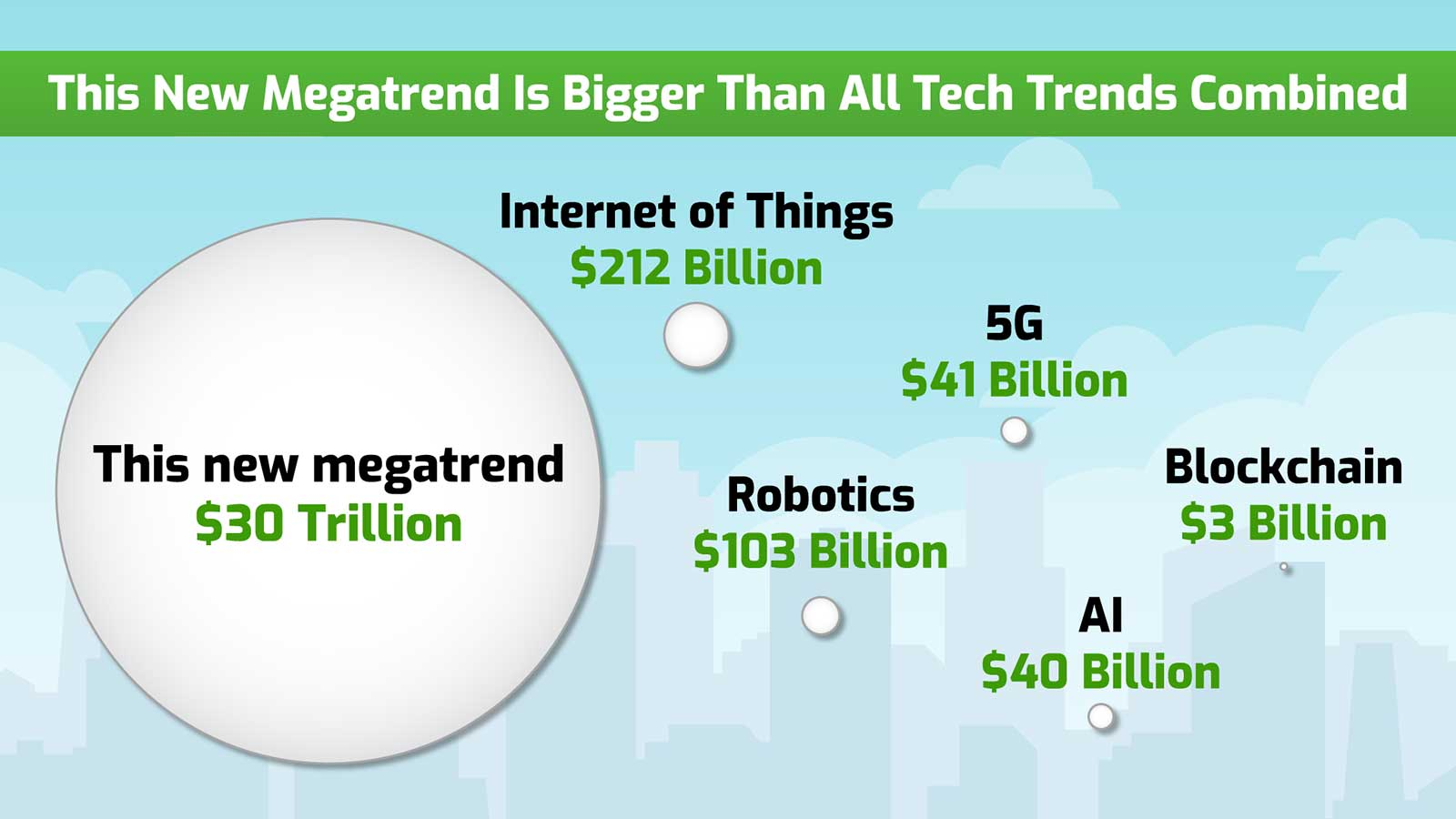

Do you know about this huge new project?

Recommended Link: He revolutionized online payment processing with PayPal…. He is revolutionizing space exploration with SpaceX and the auto industry with Tesla. And now Elon Musk is getting ready to unveil his next big project. S.A.V. will change everything…. and make a lot of people rich. Click here to watch the demo. |

Headlines you shouldn’t miss

How a minimum wage increase could affect Social Security

Retirement planning during the pandemic

This ETF could help grow your retirement nest egg

This low-fee index fund has averaged annual gains of 16% over the past ten years.

Three ways an IRA is a perfect supplement to Social Security

Don’t let misinformation keep you from the retirement you’d like to have

Is it possible to get through retirement on Social Security alone?

Retiring only on Social Security isn’t easy — but here’s how it can be done.

It’s never too late to start saving,

Gordon Fox

P.S.

Know someone who’d love the Never Too Late Investor? Be sure to send them to this link so they can get signed up: investinglate.com

Leave a Reply