Amcor (AMCR) designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home, and personal care.

While fairly uninteresting, Amcor is a reliable source of passive income. It was named to the list of payout-hiking dividend stocks at the start of 2020 after its June acquisition of Bemis. Bemis, which fell out of the S&P 500 Index and thus the Aristocrats in 2014, rejoined by merit of its merger with Amcor.

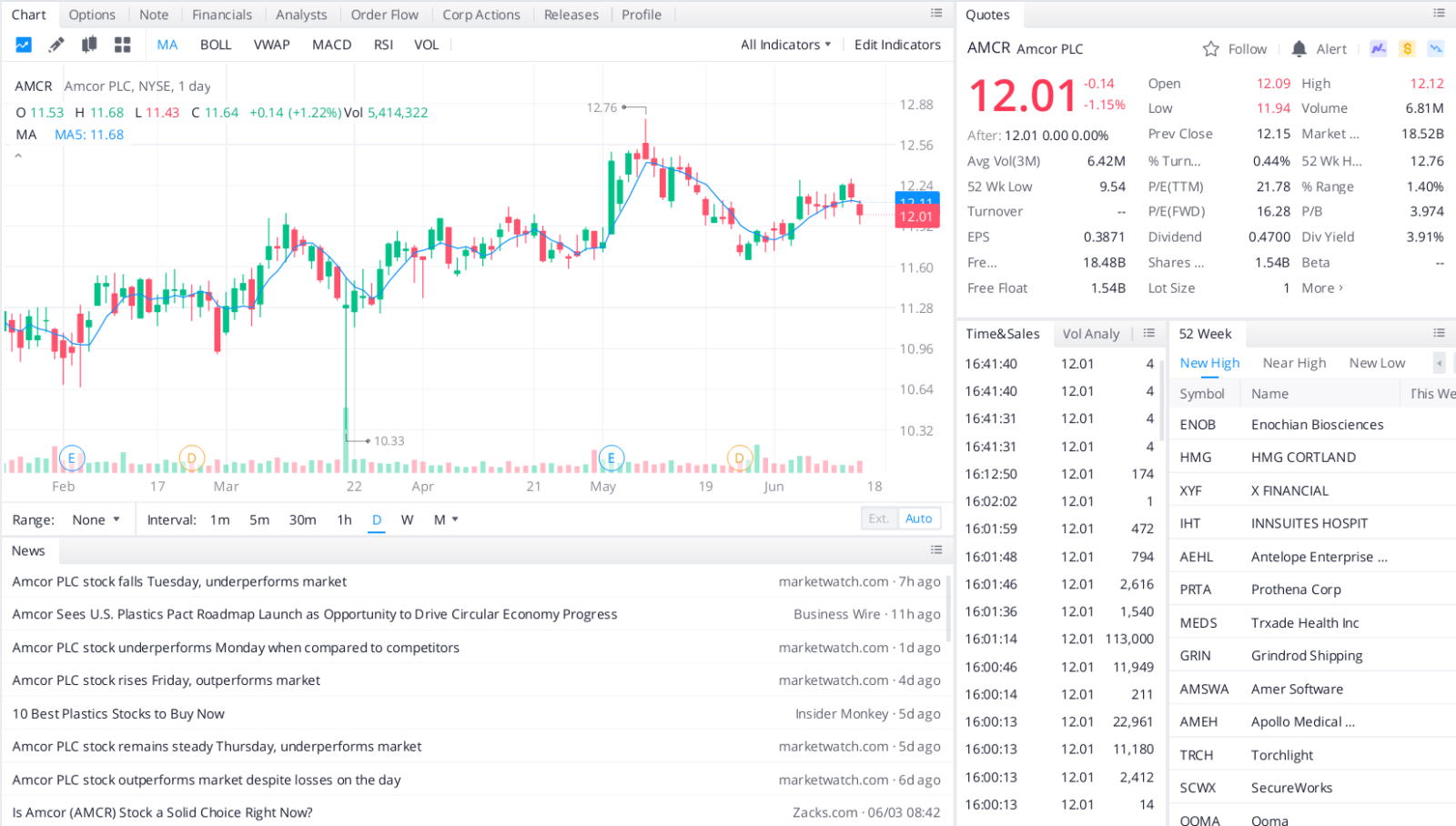

Amcor has seen solid earnings estimate revision activity over the past month, suggesting analysts are becoming a bit more bullish on the firm’s prospects in both the short and long term. So, if you are looking for a decent pick in a strong industry, consider Amcor. Not only is its industry currently in the top third, but it seems solid estimate revisions as of late, suggesting it could be a very interesting choice for investors seeking a name in this significant industry segment.

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made. The only question is, “Will you get into the right stocks early when their growth potential is greatest?”

Top headlines you shouldn’t miss

Add these super cheap stocks to your watchlist

If you are trying to double your money, check out these seven stocks

Ten of the best cheap stocks to buy this month

Absurdly cheap stocks to buy in a ridiculously expensive market

Leave a Reply