Cardinal Health (CAH) is a nationwide drug distributor and provider of services to pharmacies, healthcare providers, and manufacturers. The company has a market capitalization of $16.43 billion. CAH is well-poised for growth on the back of a diversified product portfolio, acquisition-driven strategy, and robust pharmaceutical segment. However, segmental weakness remains a concern.

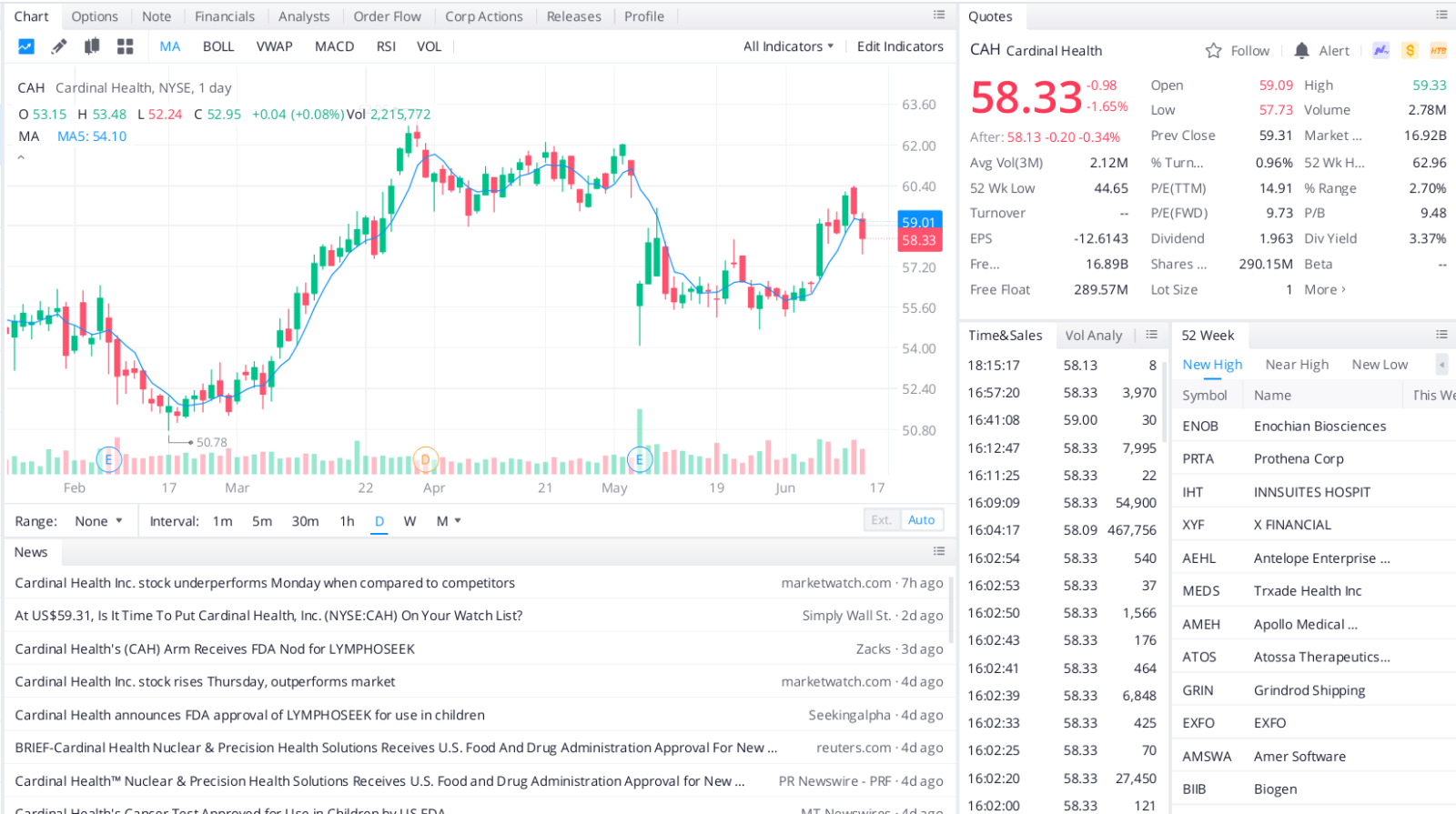

The stock has gained 9.9% compared with the industry’s growth of 7.1% in the past three months. Further, the S&P 500 Index has rallied 9.1% in the same time frame.

CAH offerings provide it with a competitive edge in the niche space. It offers industry expertise through an expanding portfolio of safe products. The company follows an acquisition-driven strategy and remains committed to investment in key growth businesses to gain market traction and bolster profits.

Cardinal Health’s Pharmaceutical segment is the second-largest pharmaceutical distributor in the United States. The segment’s products and services comprise pharmaceutical distribution, manufacturer and specialty solutions, and nuclear and pharmacy offerings. The segment’s strength is anticipated to drive its performance in the days ahead.

Top headlines you shouldn’t miss

Five healthcare stocks to buy for their game-changing potential

No-brainer stocks to buy when the next stock market crash hits

The best high yield dividend stocks to buy this month

Growth stocks to add to your portfolio this month

Leave a Reply