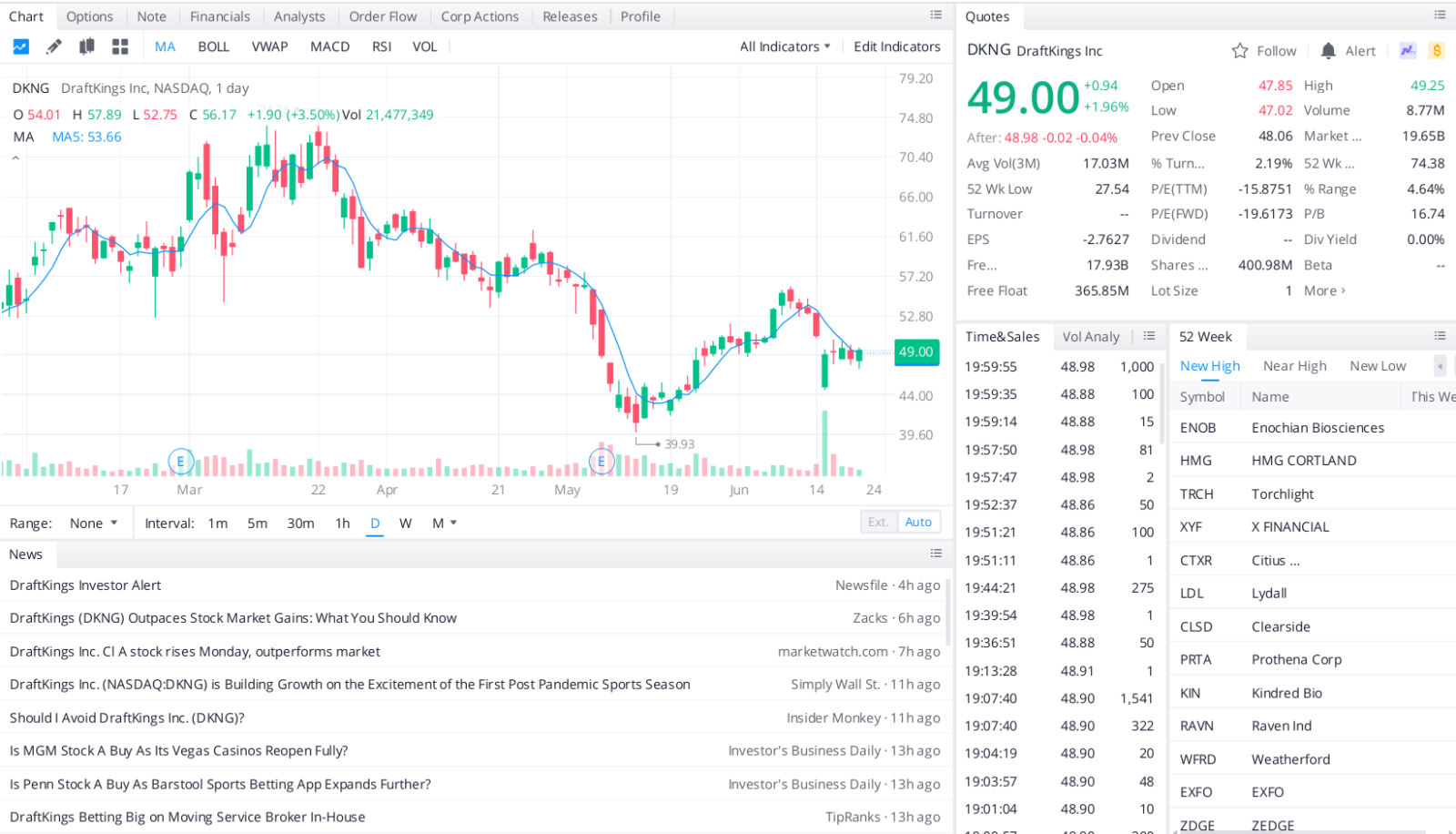

Draftkings is a Boston-based online sports betting and fantasy sports company. The stock is currently around $49, putting it about 31% below its 52-week high of $74.38.

At its current level, DKNG stock is well below where analysts expect it to be. Analysts have set its median price target at $74 a share. The high mark on the share price is $105. The median price target would represent a gain of more than 40% from where the stock currently trades.

DKNG stock is expected to take off in this year’s second half as sports resume. With the upcoming NFL football season and a growing number of U.S. states legalizing sports betting, DraftKings can generate revenue and cover budget shortfalls coming out of the Covid-19 pandemic.

The company continues to perform well financially. Draftkings posted revenues of $312 million in its first-quarter earnings. That’s nearly 35% better than analyst estimates of $231.5 million and shows 175% year-over-year growth.

Top headlines you shouldn’t miss

Two stocks to buy now before earnings for big growth upside

Seven of the best meme stocks to buy before they’re trending on Reddit

Three bargain stocks you can buy today

Here are the best alternative energy stocks to buy now

Leave a Reply