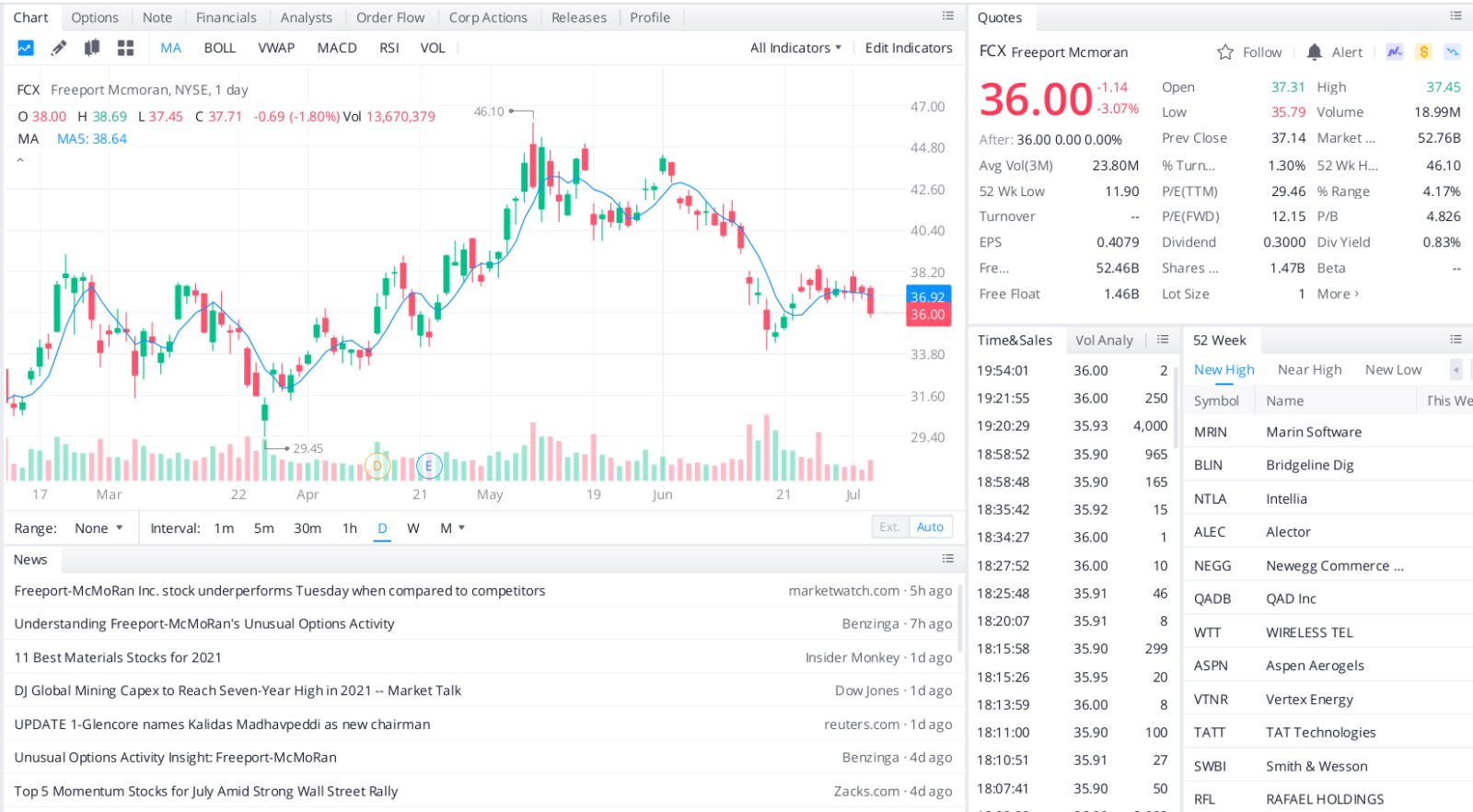

Freeport-McMoRan shares have richly rewarded shareholders of late. Although currently well off its recent high, the stock price has advanced about 240% over the past 12 months, easily topping the S&P 500’s increase of 42%.

Despite the rapid appreciation, FCX’s valuation remains below its historical average. The equity is currently priced at 12.6 times earnings, while its 10-year average is 17.0, mainly due to the significant profit advance Value Line forecasts for this year.

Freeport-McMoRan is a commodity stock engaged in the exploration and production of copper, gold, and other commodities in Indonesia, North America, South America, and Africa. Our bullish outlook for the company mainly stems from its copper operations. According to management, it mined and produced 3.2 billion pounds of copper in 2020 and had 113.2 billion pounds of copper reserves at year-end.

The current price per pound of the metal is around $4.42. This is within striking distance of its all-time high of $4.76, which was reached on May 11. For comparison, in calendar 2020, the average price of a pound of copper was $2.80.

Looking ahead, Value Line projects that Freeport-McMoRan’s earnings will increase by 36.5% annually. Increased demand for electric vehicles in the U.S. is a crucial catalyst since these autos require the use of twice as much copper as those with traditional internal combustion engines. We expect copper prices to hold up well since inventories should remain low and as the global economy gains momentum.

In 2020, FCX turned a profit of 50 cents per share (excluding 9 cents of non-recurring charges). For this year, Value Line’s estimate currently stands at $2.95, and they project that the bottom line will reach $4.35 by 2025.

Top headlines you shouldn’t miss

Ten money rules for investing success

Six of the best energy dividend stocks to buy now

Ten of the best defensive stocks to buy now

Here are the best biotech stocks to buy this month

Leave a Reply