Hannon Armstrong Sustainable Infrastructure Capital believes there are above-average returns to be gained from investing in climate-friendly solutions.

It manages over $7 billion in assets and exclusively invests in companies involved in energy efficiency, renewable energy, and other sustainable infrastructure markets. Hannon believes in its mission so much that it requires companies seeking its capital to be neutral or negative in cumulative carbon emissions or show other environmental benefits.

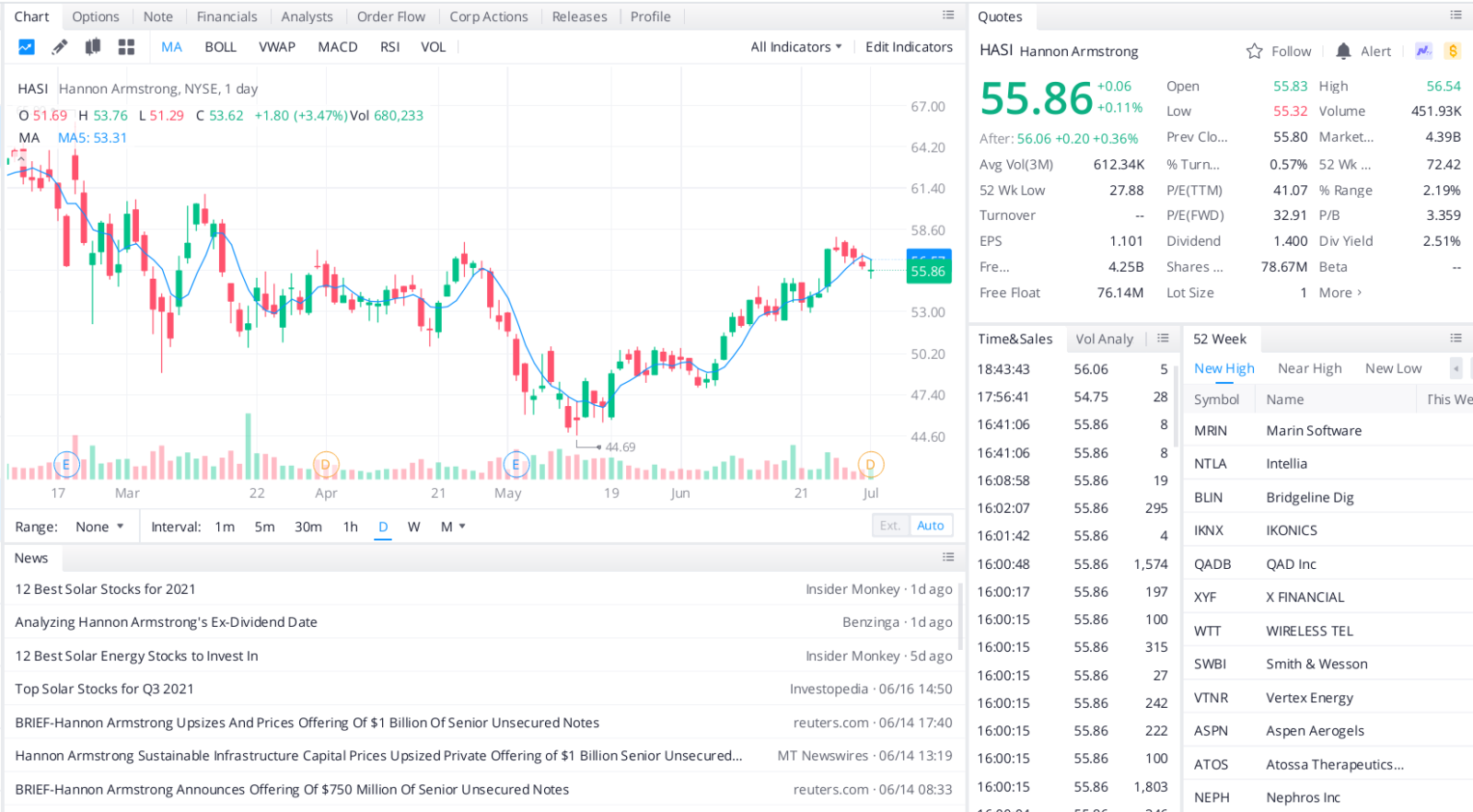

Baird analyst Ben Kallo has an Outperform (Buy) rating on the stock and a price target of $61. He notes that the company reported “solid” first-quarter results and confirmed that the CAGR of its distributable earnings would be 7% to 10% from 2021 to 2023. As for dividend-per-share growth, the CAGR is expected to come in between 3% and 5% over the same three-year period.

Hannon is a top pick among green energy stocks due to its “consistent execution, growing pipeline, and focus on renewables,” Kallo says.

HASI offers investors a “unique” opportunity to invest directly in the financing of renewable energy and energy efficiency companies, Kallo adds.

The company has helped finance more than 450 sustainable infrastructure projects since 2000. Moreover, Hannon invests in projects that tend to be “relatively low risk with recurring and predictable cash flows.” It works with “high credit quality obligors” such as federal, state, and local governments, utilities, and hospitals, the analyst says.

Riley analyst Christopher Souther also has a Buy rating on Hannon, with an $80 price target. “We are beginning to see early signs of the strong potential for the company to benefit from [the] Biden administration policy via an uptick in energy efficiency opportunities,” he says.

The consensus analyst rating on HASI is Strong Buy.

Top headlines you shouldn’t miss

The best dividend stocks to buy this month

When can HASI shareholders expect to see a dividend payment?

Are these the best dividend stocks of the year?

These stocks offer investors are a rare combo of solid earnings growth and substantial payouts

Leave a Reply