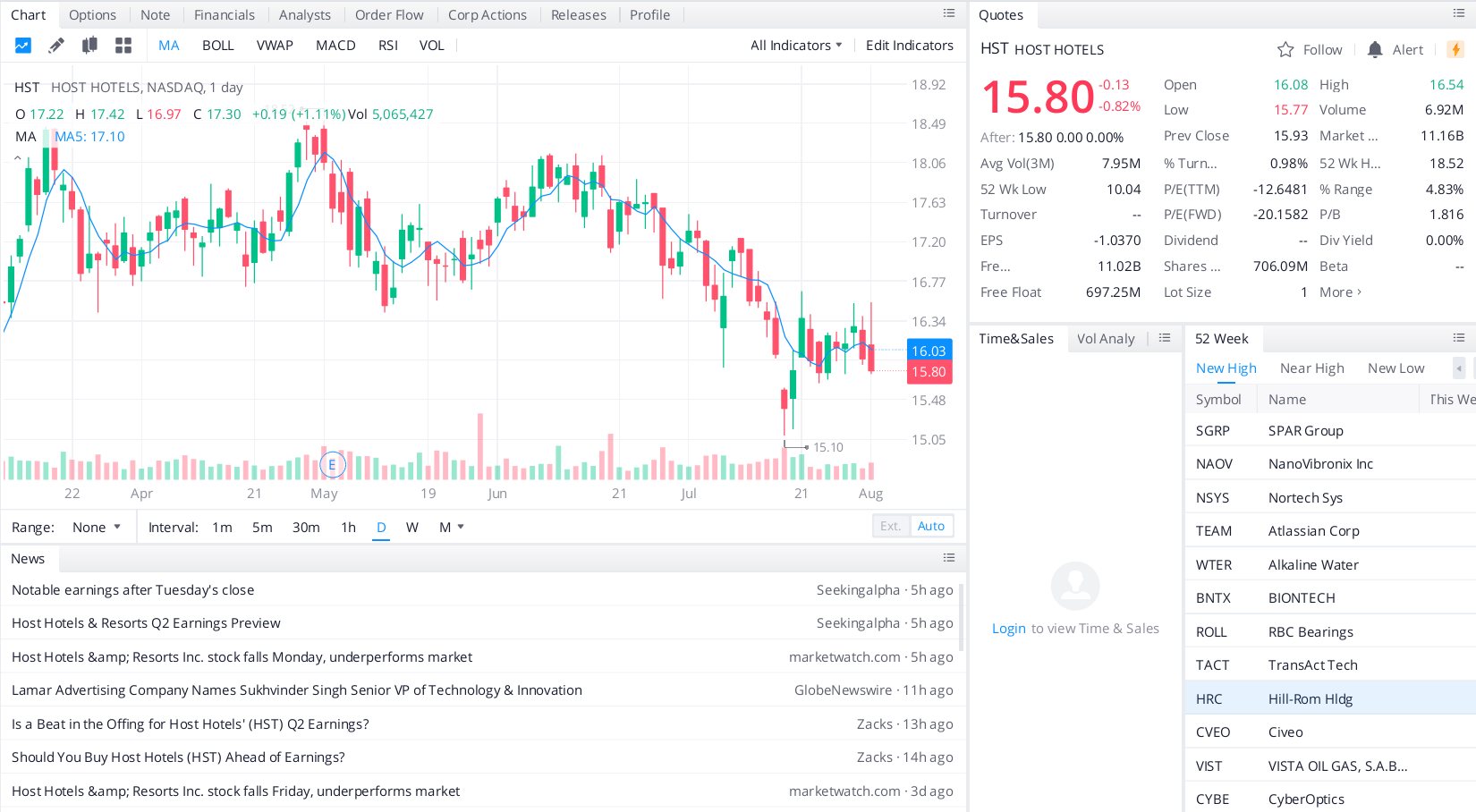

Hotel REIT Host Hotels & Resorts was another of the hard-hit names that got back to pre-pandemic price levels following the vaccine rollout. Not only that, despite the recent worries, it has only seen a slight slide from its 52-week high.

So, why is Host Hotels & Resorts stock an opportunity if you’re looking to make a contrarian wager on the outcome of the Delta variant? First, in terms of valuation, shares trade today in the middle of their historical range on an EV/EBITDA basis. Second, with the REIT taking advantage of the continued headwinds via a series of acquisitions accretive to earnings, its results could improve in a big way once the recovery is fully complete.

To top it all off, once the current issues are off the table, it will likely return to paying out its quarterly dividend of 20 cents per share (80 cents annualized). Or, perhaps it will raise its dividend once it starts paying it out again. As it trades for around $16 per share, down slightly from its high of $18.52 per share, consider HST stock as another way to bet that the “reopening” is still on track.

Top headlines you shouldn’t miss

Here are a dozen of the cheapest stocks on Robinhood

Seven cheap stocks to buy for this month

Here are the next big themes of the year according to these ETFs

Here are the best, inexpensive ETFs you can buy

Leave a Reply