Iron Mountain is an industry leader in physical record storage, which includes not only paper documents but also art, antiquities, and other high-value items.

The REIT serves around 225,000 customers worldwide and has no major competitors in the physical storage business. The average customer has stored records with Iron Mountain for 15 years and it enjoys a 98% customer retention rate.

Iron Mountain expanded into digital record storage approximately three years ago and quickly grew that business to 10% of total storage revenue. Construction projects are underway that will increase the REIT’s digital storage capacity by nearly 40% and Iron Mountain could potentially triple the storage capacity from its existing data center portfolio.

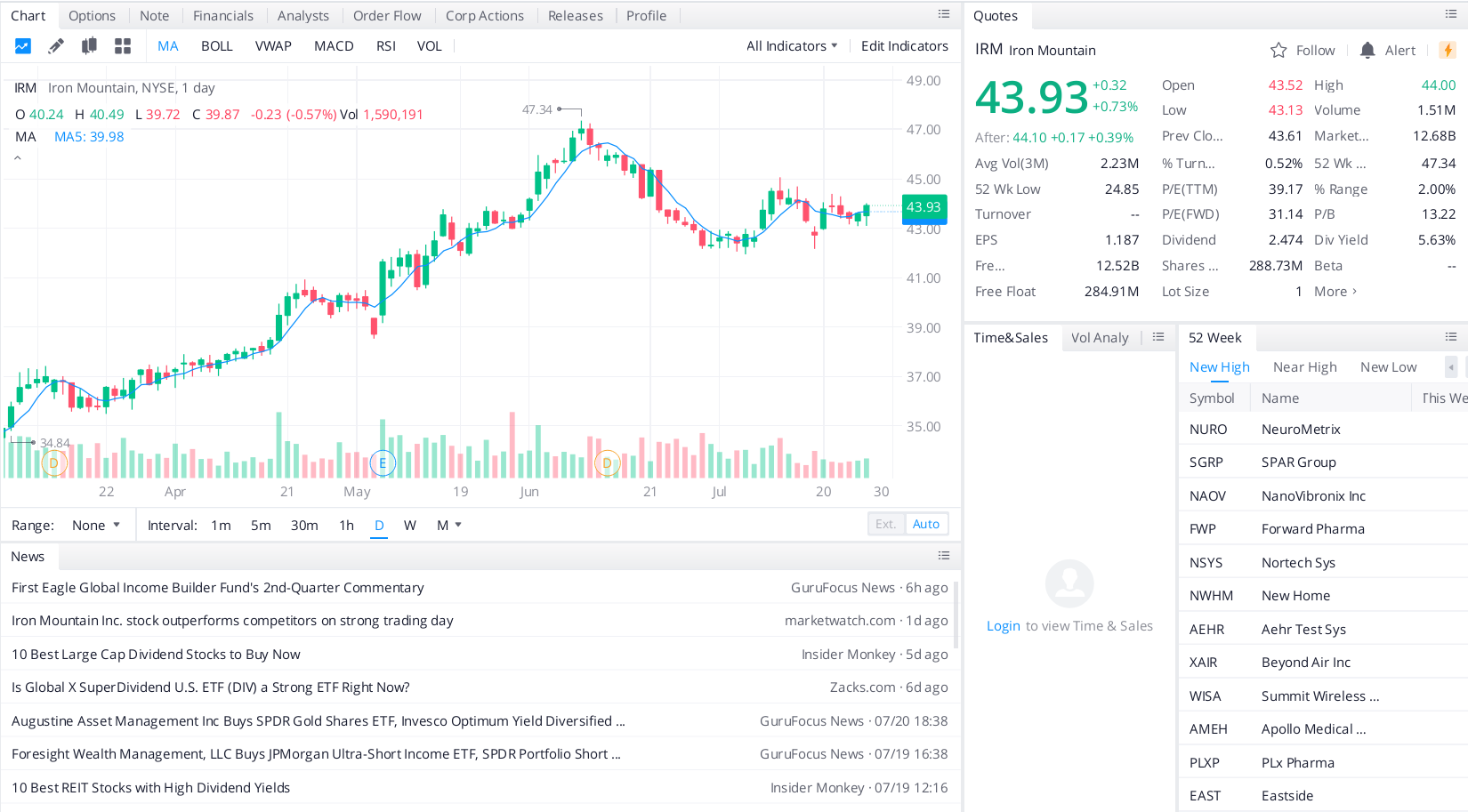

Iron Mountain delivered a solid second quarter consisting of record revenues and a 2.1% year-over-year gain in adjusted FFO. The REIT is guiding for 7% to 12% adjusted FFO per share growth this year.

This is another value REIT that has steady dividend growth. The company’s dividends have increased seven years in a row. Over the past five years, IRM has averaged a 5.1% annual dividend growth rate. The REIT maintains a dividend payout from adjusted FFO in a low to mid-60s range and a long-term target leverage ratio at a conservative 4.5 times to 5.5 times EBITDA.

Top headlines you shouldn’t miss

Are these cheap stocks on your watchlist as the month comes to a close?

You should know about these inexpensive growth stocks

These bargains could deliver generous returns to investors this year

Four fintech stocks to watch before next month

These entertainment stocks should be on your radar for next month

Leave a Reply