The maker of Coors Light, Molson Canadian and numerous other beers closed out 2020 on a weak note. Sales of $2.3 billion were below Value Line estimates and represented a year-over-year decline of 8%. The bottom line, which was hit by a huge goodwill impairment charge, came in at a loss of $6.32 per share. Even excluding that charge, the adjusted loss of 40 cents per share was still well short of analysts’ consensus estimates.

On the bright side, the situation has improved as of late, and Molson Coors achieved March-quarter profits of 39 cents per share, compared to the prior-year loss of 54 cents.

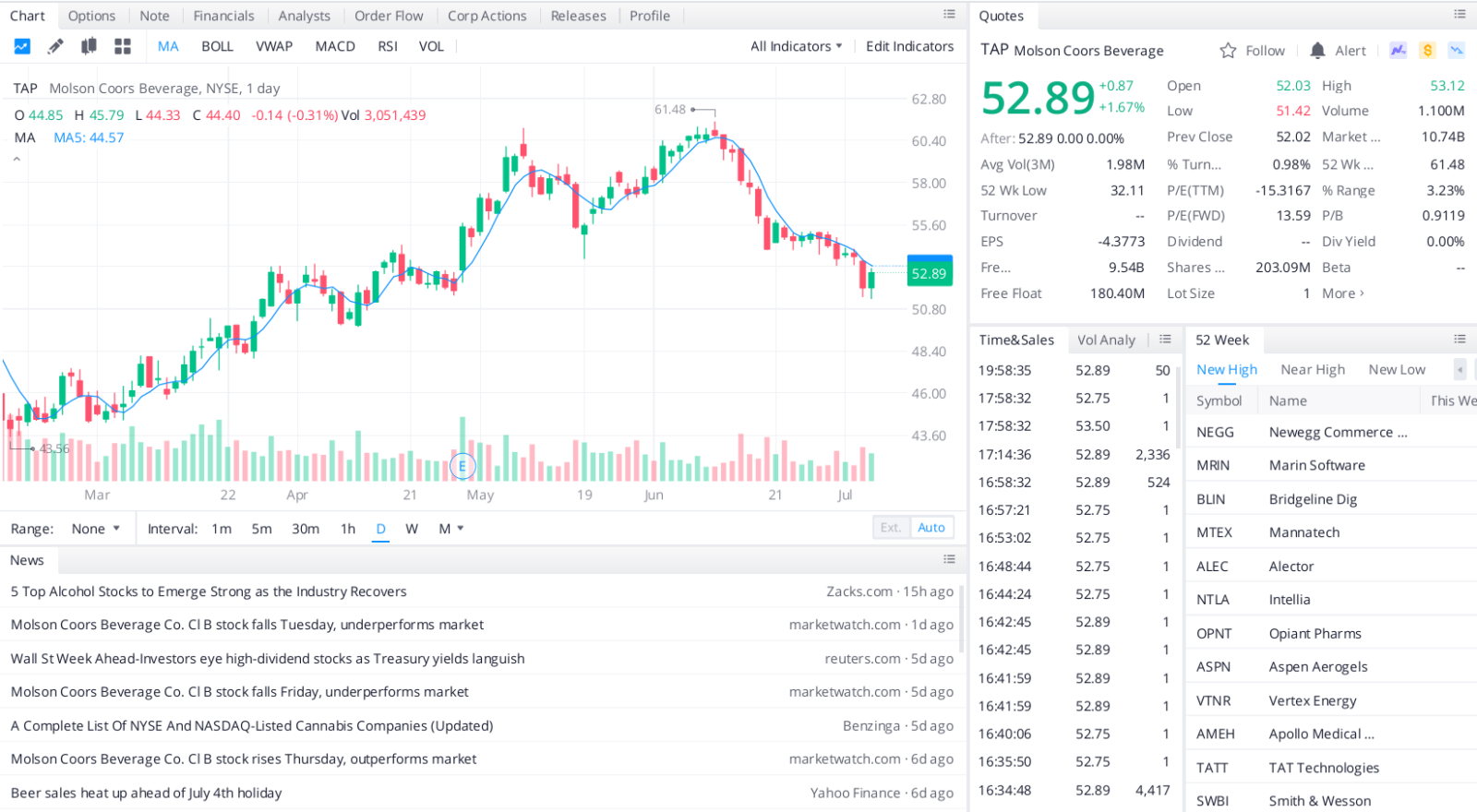

TAP stock, which has easily outperformed the S&P 500 Index so far in 2021 (20%-14%), is still trading at an appealing 15.8 times earnings, compared to its 10-year historical average of 24.0. Looking ahead, we think a more premium valuation is in the cards, and Value Line projects annual earnings growth of 41.0%. While that’s among the best estimates among our top GARP stocks, that rate admittedly is helped dramatically by 2020’s steep loss.

Our bullish outlook mostly stems from management’s “revitalization plan.” It entails pushing its core brands, aggressively growing its premium offerings and expanding beyond the beer aisle. In particular, Molson Coors recently inked a deal to distribute Superbird, a ready-to-drink tequila-based cocktail. It also debuted a line of hard seltzers named Proof Point. These endeavors provide the company with exposure to the rapidly growing ready-to-drink space.

All told, following 2020’s large loss of $4.38 per share, Value Line expects a quick recovery, leading to profits of $3.50 this year. Out five years, the bottom line might well come within reach of $5.00. If that comes to fruition, a stock price that is double its current level is easily justified.

Top headlines you shouldn’t miss

Don’t wait for the market to crash to buy this stock

Three high-dividend stocks for a low-rate environment as treasury yields sink

Here are ten SMID-cap stocks to buy that straddle both small and mid-cap companies

Do these four things before investing in digital currency

Leave a Reply