Omega Healthcare Investors is the largest REIT focused on skilled nursing facilities. It owns 954 properties across the U.S. and the U.K., representing nearly 97,000 patient beds and a portfolio net asset value of $10.2 billion as of March 31.

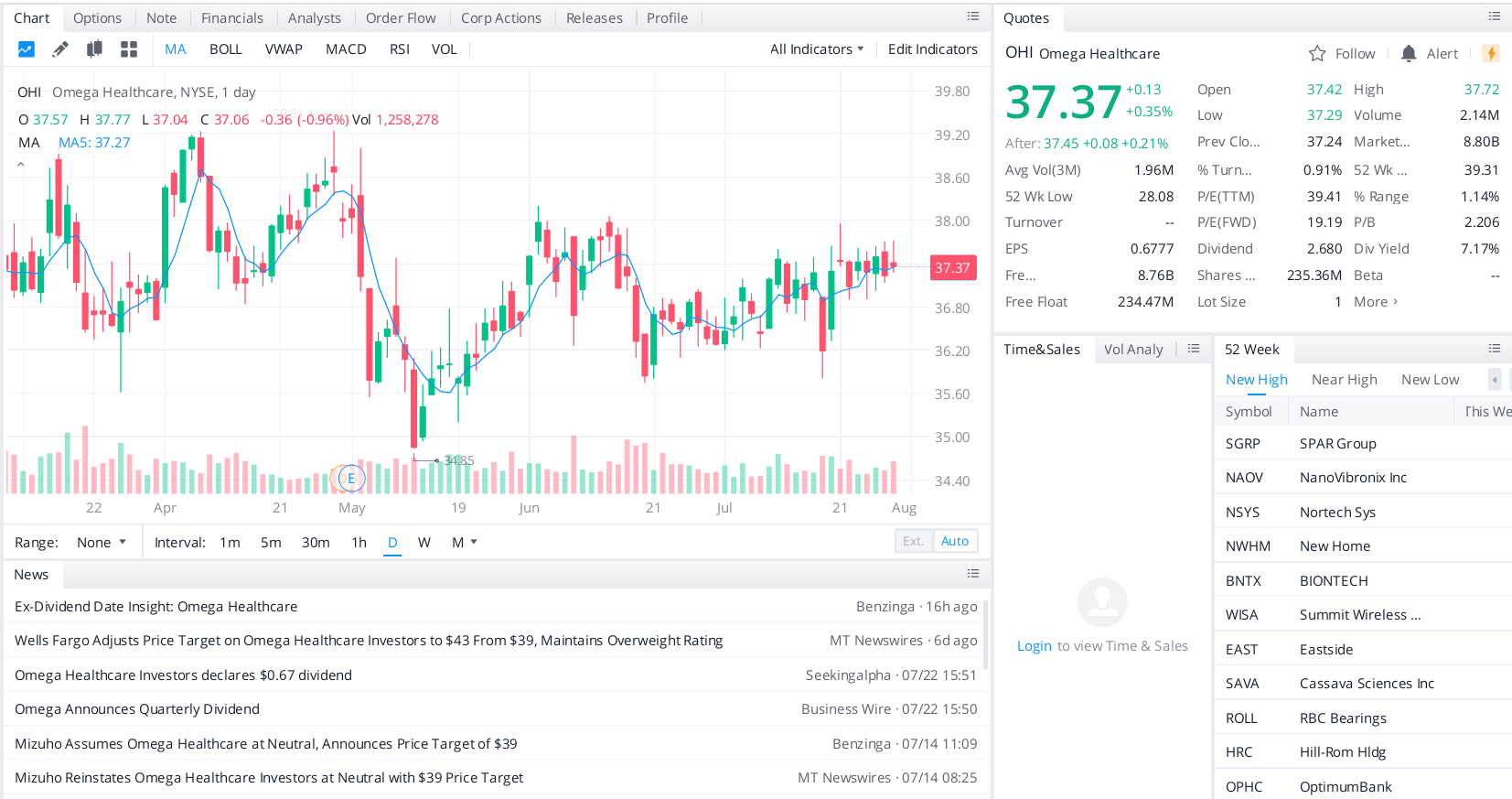

This REIT was hit hard by COVID-19 as it saw nursing home occupancy rates fall 11% from January 2020 to January 2021. OHI is on the road to recovery, though, with occupancy rates improving 3% in the first five months of this year. In addition, Omega was able to collect 99% of rents during the March quarter.

OHI has delivered nearly 9% annualized FFO growth since 2004 and 17 consecutive years of dividend hikes, including an 11% average annual increase over the past five years. However, despite its position as the largest skilled nursing operator, Omega has tapped only 5% of its potential market, and the REIT expects to double in size over the next ten years via a combination of acquisitions and development.

This high-quality REIT receives top rankings from UBS strategist Keith Parker, who named OHI among his favorite real estate picks in June. In addition, OHI shares are priced at a 12-times multiple to forward adjusted FFO and a 45% discount to industry peers.

Top headlines you shouldn’t miss

Ten medical technology stocks to consider for your portfolio

No-brainer tech stocks to buy in the next market sell-off

Hot tech stocks to buy in a market crash

These out of favor tech stocks have a massive upside

Leave a Reply