People’s United Financial is a rare banking play in this collection of dividend stocks. The regional financial services firm (which operates more than 400 branches in Connecticut, New York, Massachusetts, Vermont, New Hampshire, and Maine) has more than $63 billion in total assets. The venerable New England institution traces its roots back to 1842.

Analysts praise the bank’s “sleep well at night” loan book and its reputation as a skilled buyer of banks now that M&A activity is set to heat up. Solid capital ratios also instill confidence in the name.

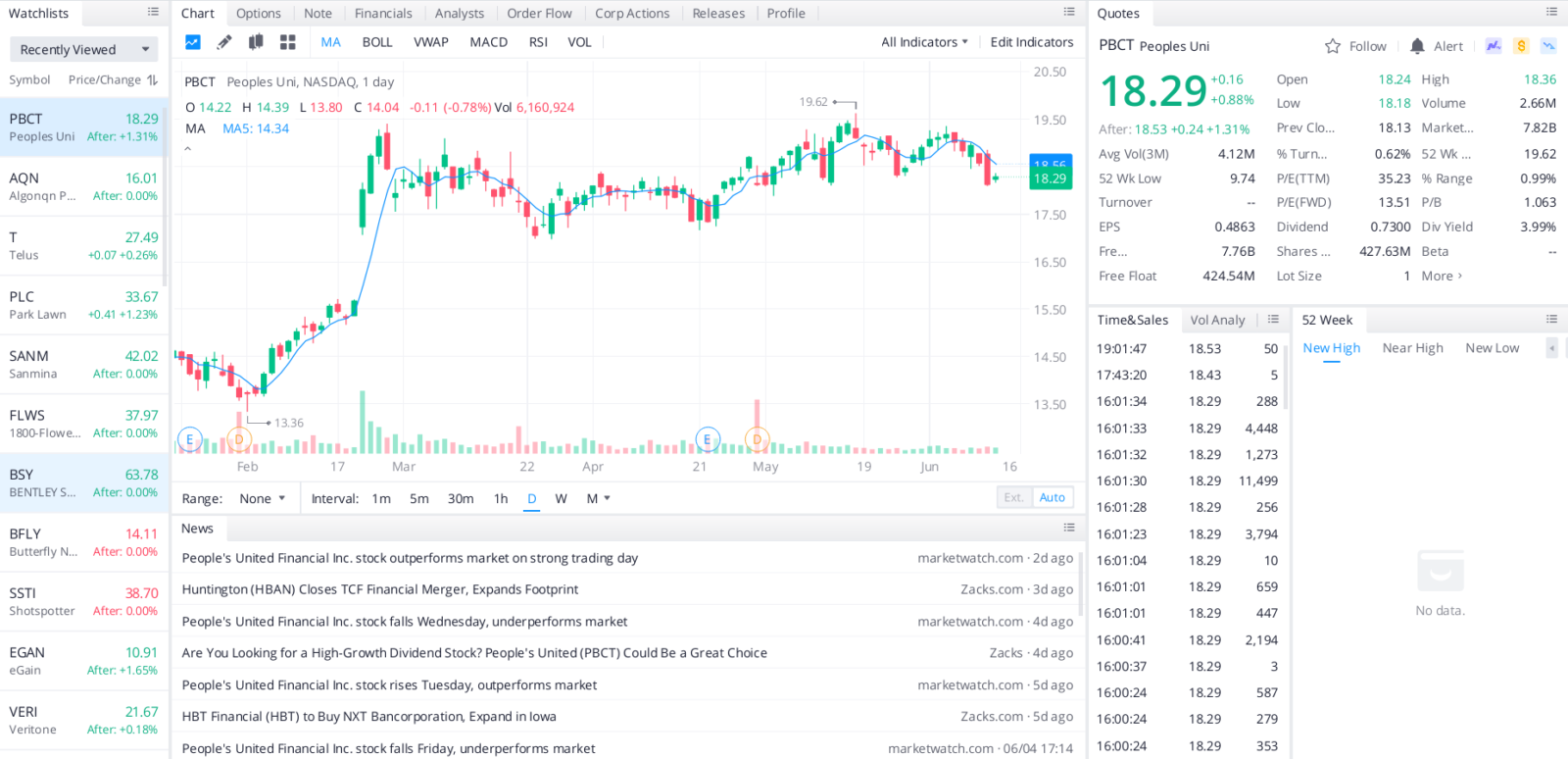

That said, the consensus recommendation on PBCT stock is Hold, and an average price target of around $18 implies an upside of just 1% in the next 12 months or so.

With more than ample free cash flow to cover the dividend and a comfortable payout ratio of 42% income, investors can feel confident that the financial services firm will continue to be one of the best dividend stocks.

Top headlines you shouldn’t miss

Four tech stocks to watch this week

The 60/40 rule of investing is dead

Five must-know investing rules for anyone new to stocks

Best stocks to buy under $20 right now

Leave a Reply