Sanmina Corporation is a circuit board manufacturer based in San Jose, California. They make circuit boards for various commercial applications, with a focus on the communications industry.

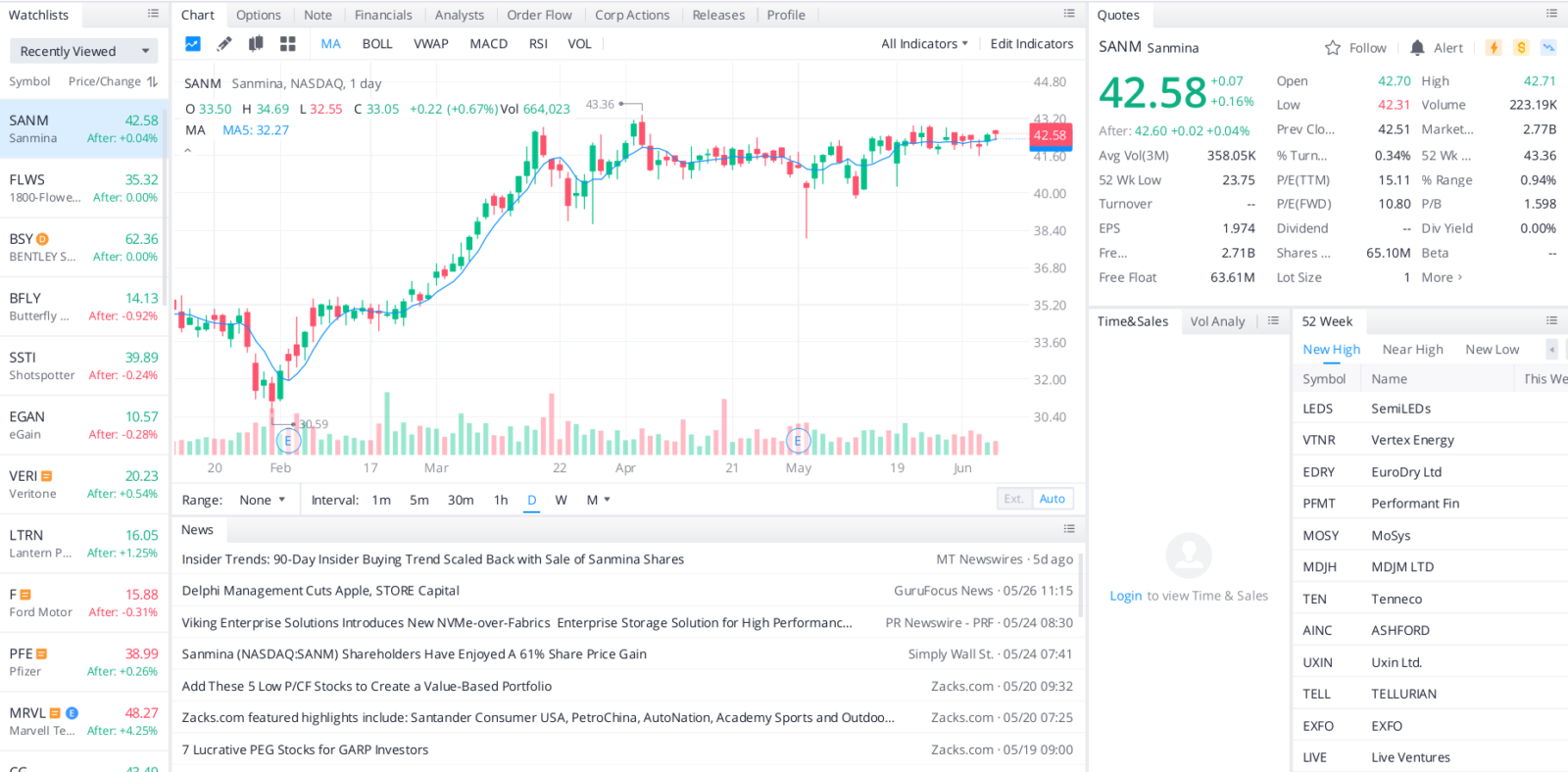

This stock has consistently performed very well over the past several months. Although they’ve delivered strong returns, their price-to-earnings ratio is still relatively low – as of late May, it is under 15. This indicates that Sanmina could be undervalued despite its recent growth.

Sanmina’s most recent earnings per share numbers beat investor estimates, although their revenue numbers were less promising. However, the stock is still trading at a five-year high.

The past few years have shown us just how important electronic devices are to every aspect of our lives. Sanmina’s circuit boards are essential to many popular electronic devices. This stock is a solid pick in the tech industry.

Top headlines you shouldn’t miss

Why this top computer and technology stock should be on your radar

These non-tech stocks are getting hit by the chip shortage

Three inexpensive stocks to watch this summer

Four of the best tech stocks to buy this month

Three ETFs for investing in cloud computing

What you need to know about psychology’s role in investing and building wealth

Leave a Reply