Sunrun, a San Francisco-based residential solar panel and home battery company, has received one analyst upgrade after another in recent months. Goldman Sachs calls Sunrun a “bellwether” solar company and raised its rating on the company to “buy” from “neutral” with a price target of $70 per share.

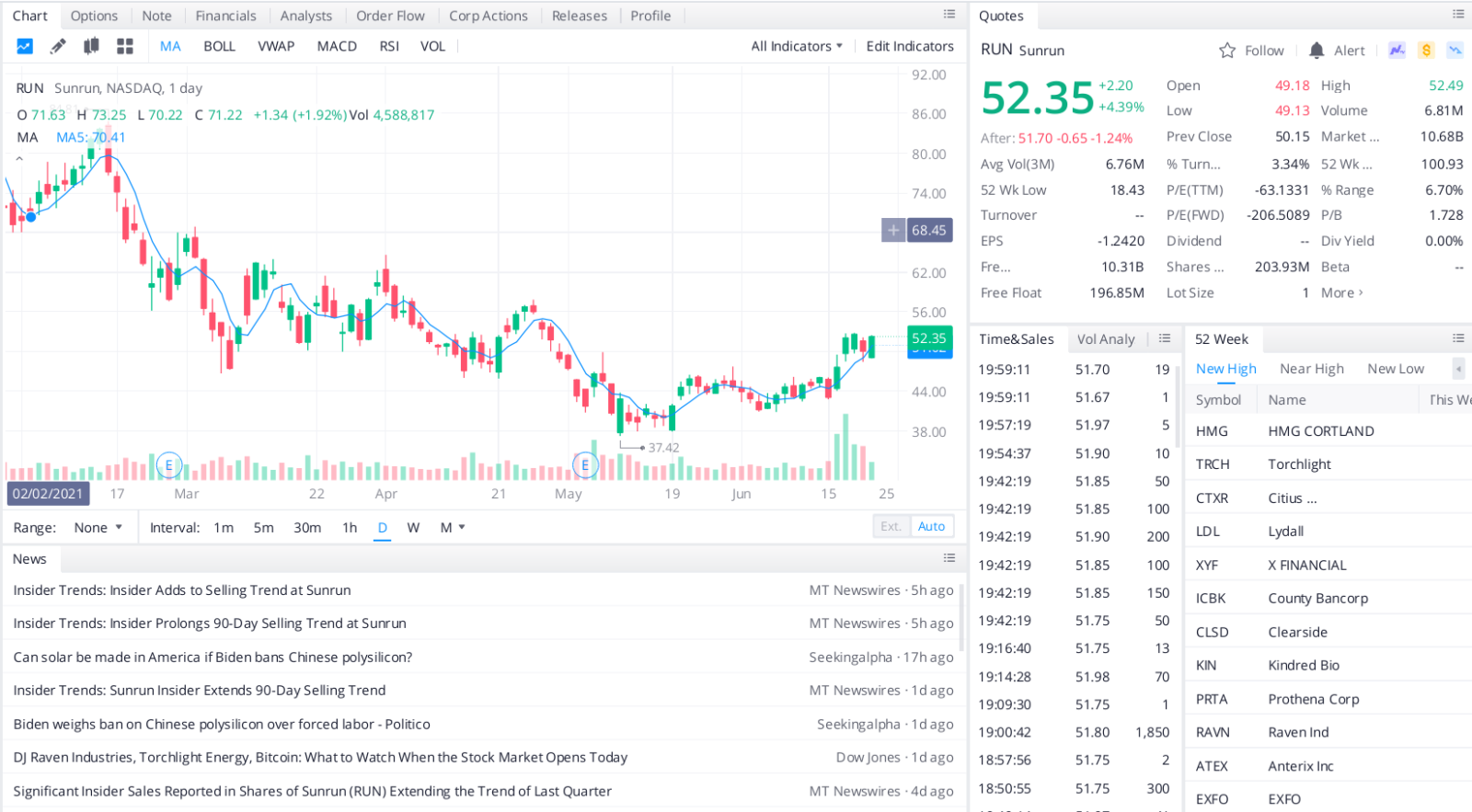

At its current share price of just over $52, RUN stock is under 50% lower than its 52-week high of $100.93 and looking mighty cheap. The stock’s decline was primarily due to supply issues that the company has since resolved.

While Sunrun remains unprofitable, it reported a narrower Q1 loss and has raised its full-year guidance for 2021. The company reported a net loss of $23.8 million, a marked improvement from a year earlier loss of $28 million. First-quarter revenue totaled $334.8 million, up 59% from a year ago. Sunrun increased its guidance to range between 25% to 30% for the entire year, up from earlier expectations of 20% to 25% growth.

Top headlines you shouldn’t miss

Seven of the best energy stocks to buy

The best alternative energy stocks to buy now

Renewable energy stocks to buy if you are betting on Geothermal

Four entertainment stocks to watch this week

Leave a Reply