TFS Financial Corporation is a provider of retail consumer banking services in the US. The company’s deposit products include savings, money market, checking, individual retirement, and other plan accounts. The company was founded in 1938.

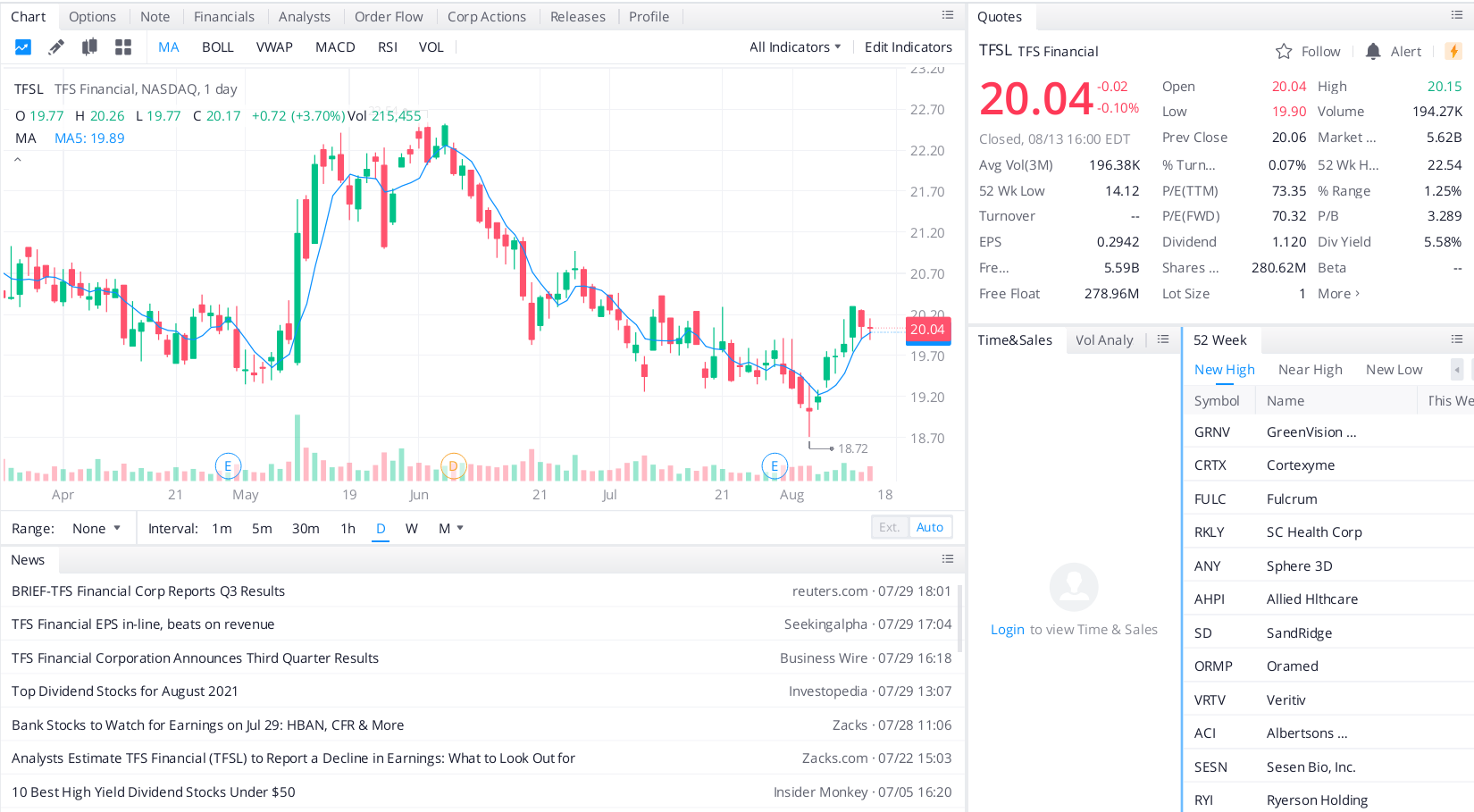

In May, TFS Financial Corporation declared its quarterly dividend of $0.28 per share. In the fiscal second quarter of 2021, TFS Financial Corporation had an EPS of $0.08, beating estimates by $0.01. In addition, the company’s revenue was $58.41 million, beating estimates by $0.61 million. The stock has gained 14.75% in the past six months and year to date.

By the end of the first quarter of 2021, 6 out of a total of 866 hedge funds that were tracked held stakes in TFS Financial Corporation, worth about $145 million total. This is compared to 10 hedge fund holders in the previous quarter, holding stakes worth roughly $136 million.

TFS Financial Corporation is a dividend stock worth your consideration.

Top headlines you shouldn’t miss

These profitable technology stocks are sure buys during a recession

These stocks are on the rise. Buy them before it’s too late

Investments that make you feel good while you make money

The future looks bright for these red-hot growth stocks

Leave a Reply