The financial history of American International Group requires immediate attention in terms of its inclusion on this list. Over the past decade, the insurance behemoth has achieved sizable profits in some years, losses, or just modest earnings in others.

That’s because insurance is a volatile business. Of course, AIG’s bottom line is heavily influenced by natural disasters that, when they strike, lead to billions in catastrophe losses and insurance payouts. On the bright side, following those events, consumers and businesses often become eager to purchase new policies or expand existing ones. American International has, however, also been able to raise rates over time steadily.

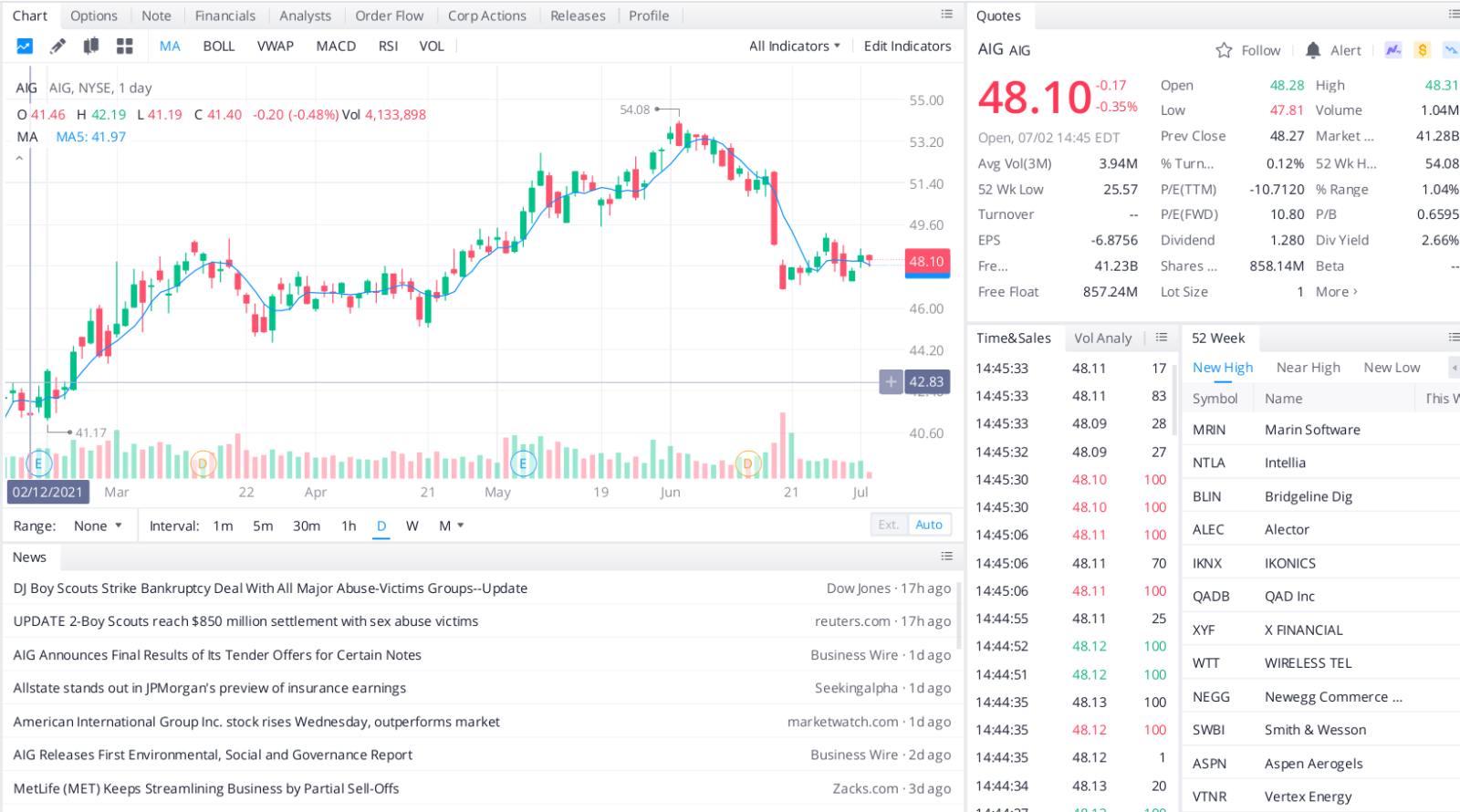

As a result of its choppy profits, AIG’s annual P/Es have spanned a broad band over the past decade. For instance, in 2020, AIG’s multiple was a hefty 38.2. The year prior, it was just 13.7, and AIG’s valuation was in the single digits in 2012 and 2013. All told, its average P/E has been 29.0 for the past ten years; however, the shares currently change hands at just 11.3 times earnings.

AIG has been struggling mightily with the collateral effects of the COVID-19 pandemic. A surge in virus-related claims activity has placed heightened pressure on profitability. What’s more, a persistently low interest-rate climate has deflated returns in the company’s investment portfolio. As a result, in full-year 2020, the company recorded insurance profits of just 89 cents per share, down from $3.69 in 2019.

However, AIG appears to be one of the best GARP stocks at the moment because it seems the situation will materially improve.

Value Line estimates profits of $4.35 per share this year and projects that earnings will reach $7.00 within the next five years. From the average of 2018 to 2020 share profits, that works out to the projected average annual growth of 28.5%.

Top headlines you shouldn’t miss

Three reasons to invest in digital currency and one reason not to

Doing this is one of the best ways to build long-term wealth

Three huge investing mistakes to avoid in your 60s

Investments vs. Student Debt: where to put your extra cash

First things first when it comes to investing for retirement

Digital currency crime is booming. Here’s how to invest safely

Leave a Reply