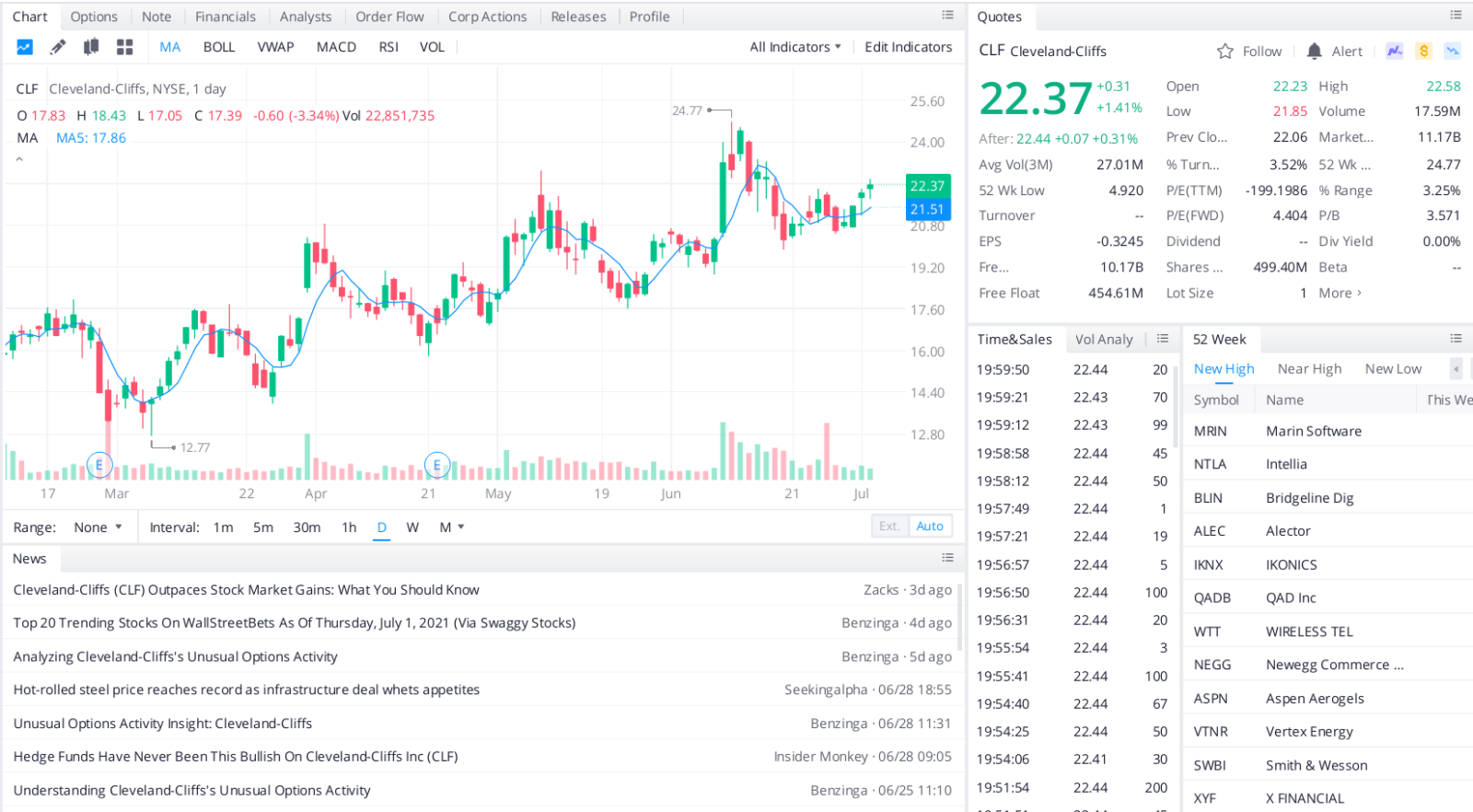

The stocks of steel manufacturers traditionally trade at modest P/Es. For example, Cleveland-Cliffs (CLF, $21.20) – which, through a couple of recent acquisitions, is now the largest flat-rolled steel producer in the United States – has traded at just 8.5 times earnings over the past decade. For comparison, the median P/E for the Value Line universe of 1,700 stocks is 19.0 over the past ten years.

Presently, CLF’s valuation is just 4.8 times earnings, suggesting that the stock is undervalued.

Flat-rolled steel refers to the processed metal that is formed via melting and stretching under significant force. It is made by placing the metal in between two rollers, and the final product is often less than 6 millimeters thick. This steel has numerous applications, including in automobiles, home appliances, shipbuilding, and construction.

In 2020, Cleveland-Cliffs successfully acquired fellow steel producers AK Steel and ArcelorMittal USA. The purchases greatly enhanced Cleveland-Cliffs’ size and scope of operations. After reporting revenues of $5.4 billion and a bottom-line loss of 32 cents per share in 2020, Cleveland-Cliffs appears poised to crush those figures this year. Thanks to the benefits and contributions from recent acquisitions, as well as the current robust pricing environment for steel, Value Line estimates that the company will achieve revenues and profits of roughly $19.1 billion and $4.40 per share, respectively, for full-year 2021.

Looking further out, pricing will probably not be as advantageous after that, but VL still projects annual growth in earnings of 26.5% out five years.

A caveat to our relatively bullish outlook is Cleveland-Cliffs’ spotty balance sheet. As of March 31, 2021, the company had $5.7 billion in long-term debt and just $110 million in cash assets. Moreover, over the past decade, due to its lackluster financial position, the company has had to suspend dividend payments. So, while CLF might offer the value and growth you’re looking for out of growth stocks, it still has a significant risk to monitor.

Top headlines you shouldn’t miss

The best environmental stocks to invest in

Four electric vehicle stocks to buy right now

Three stocks to buy that are critically important to AMC’s future

Five tech stocks to watch this week

Stocks are expensive, but that doesn’t mean the bull run is ending

Leave a Reply