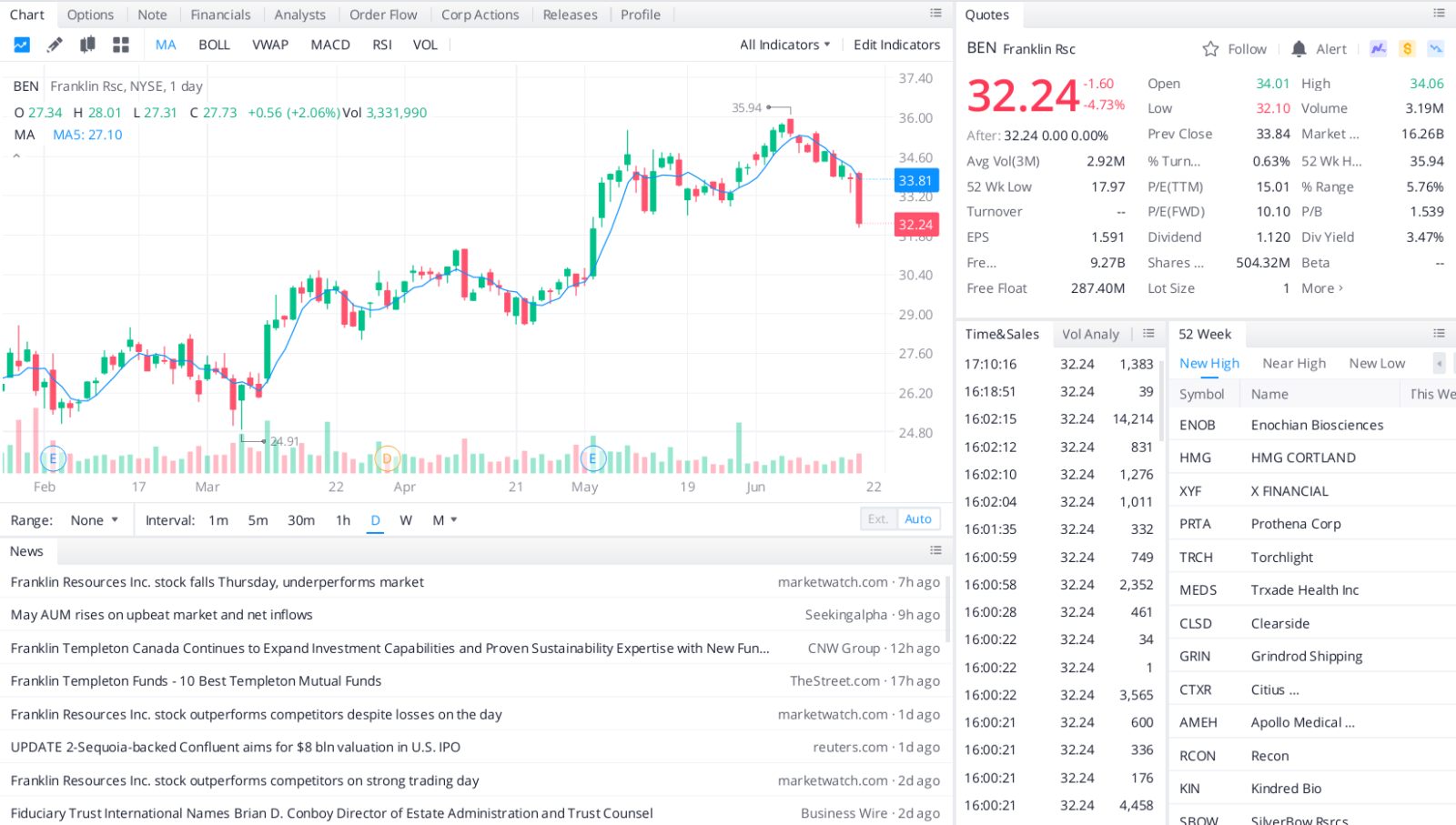

Based in San Mateo, Franklin Resources (BEN) is in the Finance sector. So far this year, shares have seen a price change of 39.22%. The investment manager is paying out a dividend of $0.28 per share at the moment, with a dividend yield of 3.22% compared to the Financial – Investment Management industry’s gain of 1.43% and the S&P 500’s yield of 1.28%.

Considering the company’s dividend growth, its current annualized dividend of $1.12 is up 3.7% from last year. In the previous five years, Franklin Resources has increased its dividend five times on a year-over-year basis for an average annual increase of 10.19%. Any future dividend growth will depend on both earnings growth and the company’s payout ratio; a payout ratio is the proportion of a firm’s annual earnings per share that it pays out as a dividend. Franklin Resources’s current payout ratio is 40%, meaning it paid out 40% of its trailing 12-month EPS as dividend.BEN is expecting earnings to expand this fiscal year as well.

From significantly improving stock investing profits and reducing overall portfolio risk to providing tax advantages, investors like dividends for various reasons. It’s essential to keep in mind that not all companies provide a quarterly payout. Investors should take comfort from the fact that BEN is not only an attractive dividend play but also represents a compelling opportunity.

Top headlines you shouldn’t miss

Ten undervalued stocks to buy now

Seven A-rated biotech stocks to buy right now

The best gold stocks to buy now

Four social media stocks to add to your watchlist

Leave a Reply