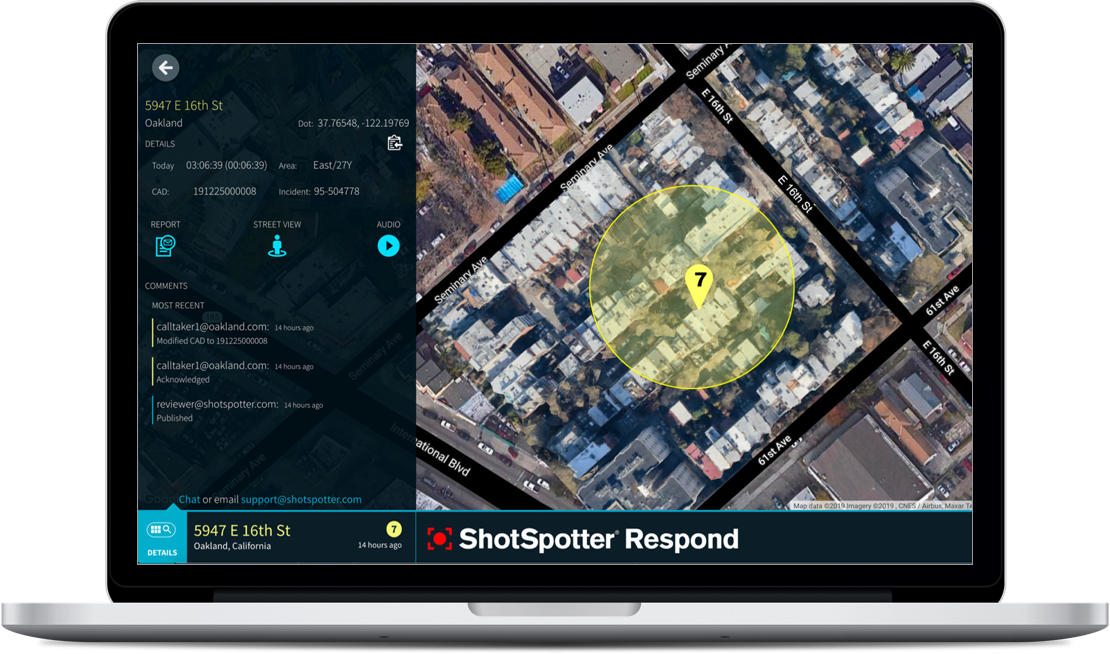

The California-based gunshot detection company uses artificial intelligence to analyze search missions and strategies to stop violence. ShotSpotted is used in over 100 cities around the US, including North Chicago, Monroe, Kankakee, and Ferguson. One of the most recent AI platforms of the company is ShotSpotter InvestigateTM. The platform is an advanced case management solution designed specifically for investigators and forensic managers.

ShotSpotter, Inc.’s revenue in the first quarter of 2021 came in at $15.0 million, up from $10.5 million in the same period of 2020. Shares of SSTI surged 86% over the last twelve months. Eight hedge funds reported owning stakes in ShotSpotter, Inc. at the end of the fourth quarter, down from 10 funds a quarter earlier. The total value of these stakes at the end of Q4 is $39.0 million.

Since ShotSpotter, Inc. is currently undervalued, it may be a great time to accumulate more of your holdings in the stock. With a positive outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as financial health to consider, which could explain the current undervaluation.

Top headlines you shouldn’t miss

- Seven best stocks to buy to hedge against a potential downturn

- Three stocks you can buy and hold for the next decade

- Five stocks that have potential to be big summertime winners

- Three digital payment stocks to watch right now

- Two of the best value stocks to buy now

- Four growth stocks to buy now at a sell-off discount

Leave a Reply